💥 Want to 10X Your Wealth? Start SIP in Midcap Funds Today!

In the world of investing, there are many ways to grow your wealth, but few are as powerful as the Systematic Investment Plan (SIP). If you’re looking to build significant wealth over time, particularly with the potential for higher returns, investing in Midcap Funds through SIP can be an excellent strategy.

Midcap funds have the unique ability to offer high returns, but they come with moderate risk, making them ideal for investors who are ready to take on a bit more volatility in exchange for greater growth potential. In this blog, we will explore how SIP in midcap funds can potentially 10X your wealth, and why 2025-2030 could be the perfect window to start your investment journey.

We will also provide a step-by-step guide on how to start investing in midcap funds, and the role SBI Mutual Funds can play in your wealth-building strategy. Plus, don’t forget to check out the insightful video below that explains this investment strategy in more detail.

What Are Midcap Funds and Why Should You Invest in Them?

Before we dive into how SIP can 10X your wealth in midcap funds, let’s first understand what midcap funds are.

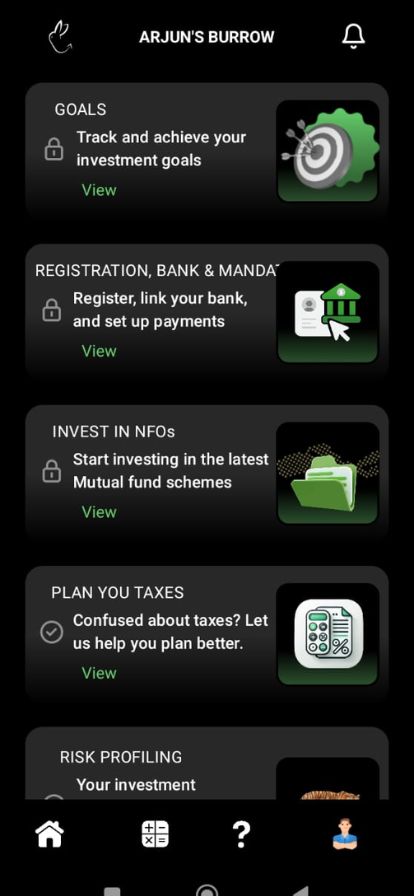

🇮🇳 India’s First AI-Based Mutual Fund Investment App!

🎯 Free Smart Recommendations to avoid overlapping funds & achieve your financial goals.

💰 Start Investing Smartly with the SanchayKaro App!

(Powered by Rabbit Invest: Mutual Funds)

✅ Simple & Easy Process

✅ Goal-Based Investment

✅ Tax-Saving Made Simple

✅ Create Your Own Risk Profile

✅ Invest Safely – Avoid Risky F&O Trades

🚫 Don’t waste your hard-earned money on Share Market F&O!

💡 Grow it steadily through Mutual Funds — guided by AI & expert tools.

Now track & invest in mutual funds anytime, anywhere.

Download now 👇

📲 Android: https://play.google.com/store/apps/details?id=com.rrabbit.sanchaykaro&pcampaignid=web_share

📲 Apple: https://apps.apple.com/in/app/sanchay-karo/id6755289848

Smart Investment. Simple Process. Secure Platform. 🔒📈

What Are Midcap Funds?

Midcap funds invest primarily in mid-sized companies—companies that are larger than small-cap companies but not as established or large as blue-chip companies. These companies typically have a market capitalization between ₹5,000 crore and ₹20,000 crore.

The key characteristics of midcap funds are:

- Growth Potential: Midcap companies often have significant room to grow, which makes them attractive to investors looking for higher returns.

- Higher Risk: Due to their size and volatility, midcap companies are riskier than large-cap companies, which makes them suitable for risk-tolerant investors.

- Diversified Portfolio: Midcap funds typically hold a mix of sectors and companies, giving investors exposure to different industries and growth prospects.

- Higher Returns: Historically, midcap funds have delivered higher returns compared to large-cap funds, although they can be more volatile in the short term.

Why Choose Midcap Funds for SIP?

Investing in midcap funds through SIP offers several advantages:

- Potential for High Returns

While midcap stocks can be volatile, they often experience substantial growth over time. Investors who stay invested in these funds for the long term (5-10 years) can see significant returns that can outpace inflation and other traditional investments. - Diversification

Midcap funds provide exposure to companies that are often underrepresented in large-cap index funds. By investing in midcap stocks, you’re adding a layer of diversification to your portfolio, which helps balance risk and return. - Affordability with SIP

One of the best ways to invest in midcap funds is through SIP. You can start with as little as ₹500 per month, and by staying consistent, you can accumulate significant wealth. SIP also allows you to invest regularly, regardless of market conditions, which takes the guesswork out of timing the market. - Rupee Cost Averaging

With SIP, you invest the same amount every month, which means you buy more units when the market is down and fewer when the market is up. This approach helps in averaging the cost per unit, making your investment less susceptible to market fluctuations.

How SIP in Midcap Funds Can Help You 10X Your Wealth

The idea of 10X-ing your wealth might seem ambitious, but it’s not entirely impossible, especially if you’re starting early and following a disciplined approach with SIP.

Here’s how SIP in midcap funds could help you achieve this goal:

- Compounding

The magic of compounding works best when you invest regularly over an extended period. Even a small amount invested through SIP in midcap funds can grow exponentially over time. As your investment earns returns, those returns themselves generate more returns, leading to exponential growth. - The Power of Time

One of the greatest advantages of SIP is that it encourages long-term thinking. By staying invested for 5-10 years or longer, your midcap investments can have enough time to ride out market fluctuations and take advantage of the companies’ growth trajectories. Historically, midcap stocks have delivered returns in the range of 12%-18% annually over the long term, which could lead to significant wealth creation. - Dollar-Cost Averaging

By investing through SIP, you’re averaging your purchase price over time. When the market is low, you buy more units for your investment amount, and when the market is high, you buy fewer units. This reduces the risk of investing a lump sum at a market peak and helps you accumulate more units during market dips. - Higher Growth Potential of Midcap Stocks

As midcap companies grow and mature, they tend to outperform established blue-chip companies. Many of India’s top companies today started as midcap stocks, and their growth trajectory in the next decade could offer significant returns. The next Infosys, HDFC Bank, or Asian Paints might be among the midcap stocks you invest in today.

Best Midcap Funds to Consider for SIP in 2025-2030

If you’re ready to start your SIP in midcap funds, choosing the right fund is crucial to achieving maximum returns. Here are some of the best SBI Mutual Funds midcap options for long-term investors:

1. SBI Magnum Midcap Fund

The SBI Magnum Midcap Fund primarily invests in mid-cap companies that are poised for growth. This fund has a track record of delivering solid returns over the years and is ideal for investors looking for aggressive growth.

- Best For: Investors seeking high growth over the long term.

- Risk Level: High (due to the nature of midcap stocks)

- Why Choose This Fund: Consistently strong performance and a diversified portfolio of midcap stocks make this fund a great choice for SIP.

2. SBI Focused Equity Fund

While not exclusively a midcap fund, the SBI Focused Equity Fund focuses on high-conviction stocks across different market caps, including midcap stocks. The fund’s strategy of focusing on fewer, high-potential stocks can deliver higher returns in the long run.

- Best For: Investors looking for focused exposure to midcap and large-cap stocks.

- Risk Level: Moderate to High

- Why Choose This Fund: The fund’s concentrated portfolio allows it to benefit from high-growth potential while minimizing risks from over-diversification.

How to Start Investing in Midcap Funds via SIP?

Starting your SIP in SBI Mutual Funds is simple and hassle-free. Here’s a step-by-step guide:

- Download the SBI Mutual Fund App

The SBI Mutual Fund App makes investing in SIPs easy and convenient. You can track your investments, set up SIPs, and explore different fund options at the click of a button. Download the app here. - Visit www.sanchaykaro.com

For expert reviews, tips, and advice on the best SIP plans, visit www.sanchaykaro.com, a trusted resource for mutual fund investors. - Choose the Best Fund and Set Up Your SIP

After browsing through the options, choose the midcap fund that suits your financial goals. You can start your SIP with as little as ₹500/month and increase it as your financial situation improves. - Monitor Your Investments

Track your investments regularly through the SBI Mutual Fund app or the website. Make sure you review the performance of your fund periodically, and adjust your SIP contribution as necessary.

Watch the Video for More Insights

For a deeper understanding of how to 10X your wealth with SIP in midcap funds, check out this helpful video:

👉 Watch the Video: How SIP in Midcap Funds Can 10X Your Wealth

Conclusion

If you want to 10X your wealth, starting an SIP in midcap funds is one of the most effective ways to do so. By investing regularly, harnessing the power of compounding, and selecting the right midcap funds like those from SBI Mutual Fund, you can position yourself for high returns over the long term.

Start your SIP today, be patient, and watch your investments grow exponentially. SBI Mutual Funds provide the perfect opportunity to maximize your returns and secure your financial future. Happy investing!

Disclaimer: Mutual fund investments are subject to market risks. Please read the offer document carefully before investing.

Ask ChatGPT