Stop losing money in Futures and Options trading. Become a smart investor with Sanchay Karo's systematic investment plans. Our mutual funds app provides AI-powered recommendations for long-term wealth creation. Start your SIP journey today with secure, regulated investments.

Discover the difference between risky trading and smart investing. Our systematic investment approach helps you build wealth securely while avoiding common trading pitfalls.

Get your portfolio reviewed yearly at no cost to ensure it aligns with your financial goals.

Skip the stress and high risks of Futures & Options trading. We guide you toward safe, long-term wealth creation through mutual funds.

Start your journey to financial independence early with our systematic investment approach.

Get personalized fund suggestions powered by advanced AI algorithms tailored to your risk profile.

Complete your KYC seamlessly through NSE Mutual Fund platform for quick account setup.

Your investments are protected through SEBI-registered platforms and AMFI-regulated funds.

Begin your systematic wealth creation journey with our simple, secure, and guided process for mutual fund investments

Get Sanchay Karo from Play Store or App Store. It's free!

Paperless KYC with Aadhaar & PAN. Takes only 2 minutes!

Understand your risk appetite with our smart assessment tool

One-time registration for automatic SIP payments

Mandate activates within 72 hours. Start your investment journey!

Complete process in under 10 minutes

Bank-level security & encryption

Start with just ₹500 per month

Monitor & manage anytime, anywhere

For Lumpsum Investments: You can invest any amount, anytime without mandate registration. Perfect for parking surplus funds!

Join 1,00,000+ smart investors who trust Sanchay Karo

Maximize your wealth creation while enjoying significant tax benefits through ELSS funds and other tax-saving instruments

Invest in ELSS (Equity Linked Savings Scheme) through SIP and claim tax deductions up to ₹1.5 lakh annually.

While not directly related to SIP, health insurance premiums can be claimed alongside your investments for comprehensive financial planning.

Benefits on equity-oriented mutual funds held for more than 12 months with favorable tax treatment.

Other tax-efficient investment options available through Sanchay Karo for comprehensive financial planning.

Explore our comprehensive range of investment options tailored to your financial goals and risk appetite

Become a Sanchay Karo partner and start earning commission while helping others achieve their financial goals.

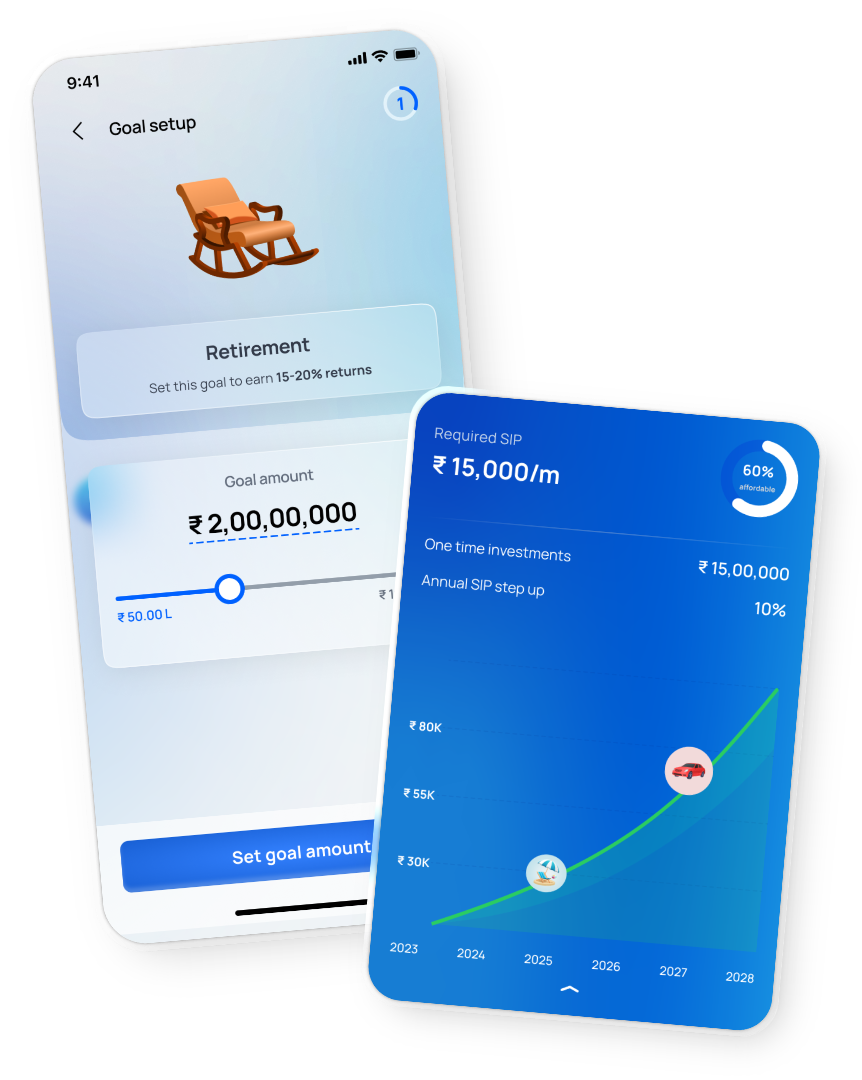

Build wealth systematically with AI-powered, goal-based mutual fund investments. Get smart fund suggestions, track your portfolio with ease, and stay on track with reminders.

Secure your retirement with India's voluntary, long-term retirement savings scheme offering additional tax benefits.

Invest in Indian mutual funds from anywhere in the world with simplified processes and dedicated NRI support.

A Systematic Investment Plan (SIP) is a disciplined approach to investing in mutual funds where you invest a fixed amount regularly (monthly, quarterly, etc.) instead of making a lump-sum investment. This method helps in rupee cost averaging and compounding returns over time.

With Sanchay Karo's SIP platform, you can start investing with as little as ₹500 per month. Our AI-powered recommendations help you choose the right mutual funds based on your risk profile and financial goals.

Systematic Investment Plans offer several advantages over traditional lump sum investments:

For most investors, mutual funds offer a safer and more efficient way to participate in equity markets compared to direct stock trading:

For more information about investing and financial planning, explore these authoritative resources:

Join thousands of satisfied investors who trust Sanchay Karo for their financial goals and wealth creation journey

Track & invest in mutual funds anytime, anywhere with our user-friendly mobile app for systematic wealth creation

Quick access to customer and distributor dashboards for managing your investments and partnerships

STOP Wasting Your Hard-Earned Money on F&O Trading!

Download Sanchay karo app & start Investment With SIP

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor | PALLAB ROUTH | ARN – 301757 | EUIN : E572917 |Date of Registration: 22-07-2024 | Current validity: 15-07-2027

WhatsApp us