Hello! Let’s find your perfect investment match.

Welcome to SanchayKaro! We believe your investments should be as unique as you are. Instead of a boring form, we use a fun, quick quiz to match you with an “Investment Animal” personality. This helps us recommend funds that truly suit your goals and comfort level.

Let’s get started!

Part 1: Creating Your Risk Profile (The Fun Quiz!)

- Step 1: Access the Quiz

- Open the SanchayKaro app and log in. On your dashboard, look for a button that says “Discover Your Risk Profile”

📲 Android: https://play.google.com/store/apps/details?id=com.rrabbit.sanchaykaro&pcampaignid=web_share

📲 Apple: https://apps.apple.com/in/app/sanchay-karo/id6755289848

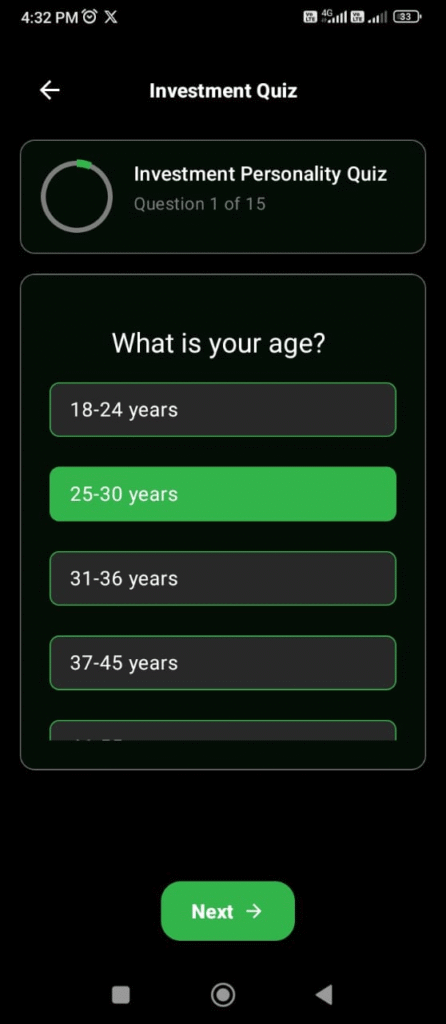

- Step 2: Access the investment Quiz

To proceed, please provide your age by selecting it or stating it here, then I can guide you to the next step.

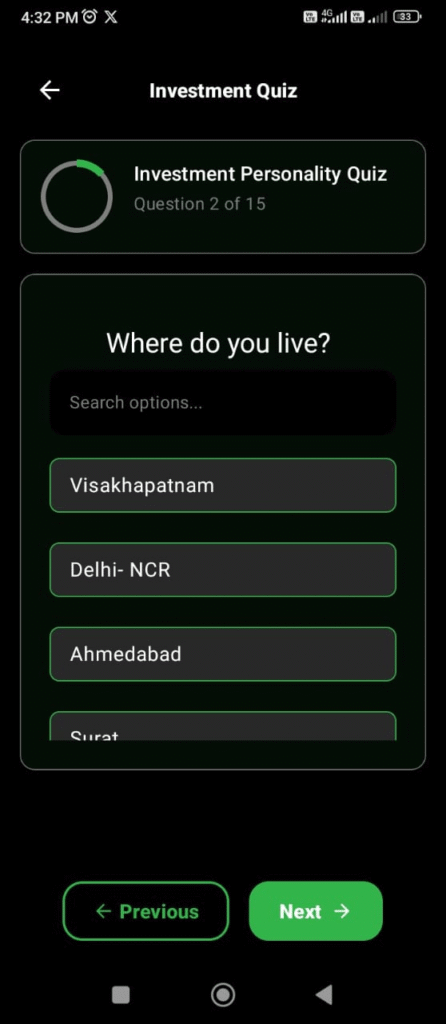

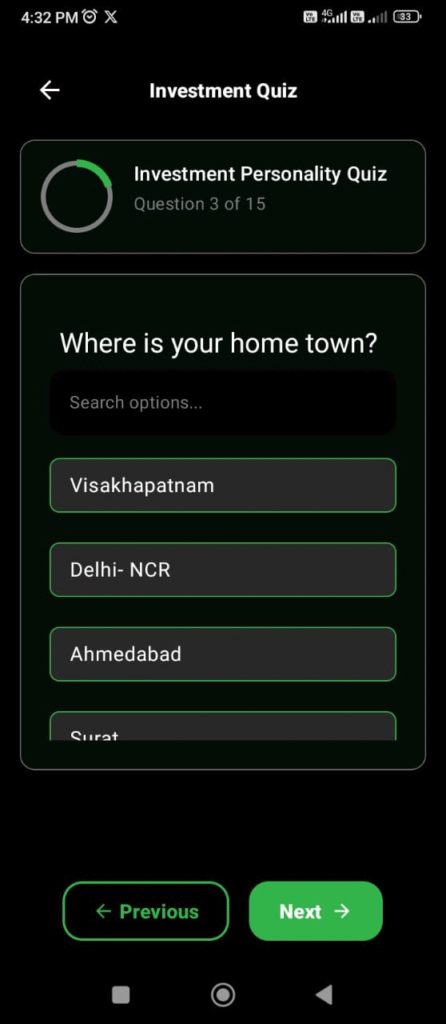

- Step 3: Access the investment Quiz

Please specify or select your place of residence by naming your city, state, or country. Once you provide that information, you can proceed by clicking “Next” or letting me know to move forward.

- Step 4: Access the investment Quiz

Please enter the name of your hometown or location in the search box provided and then click on “Next” to continue. If you specify your hometown here, I can assist you further with the next steps.

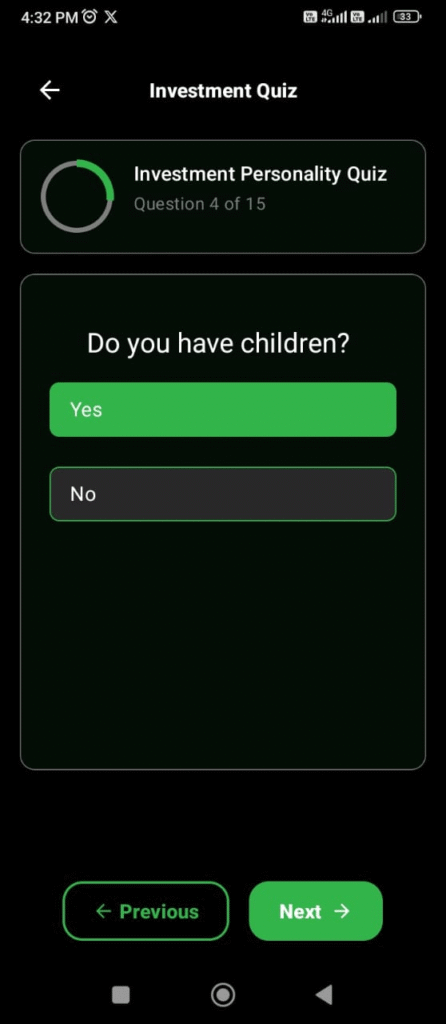

- Step 5: Access the investment Quiz

When asked “Do you have child?” in an online or paper form, you should select or indicate your answer based on your actual current situation:

- If you do not have any children, select or answer “No.”

- If you have one or more children, select or answer “Yes.”

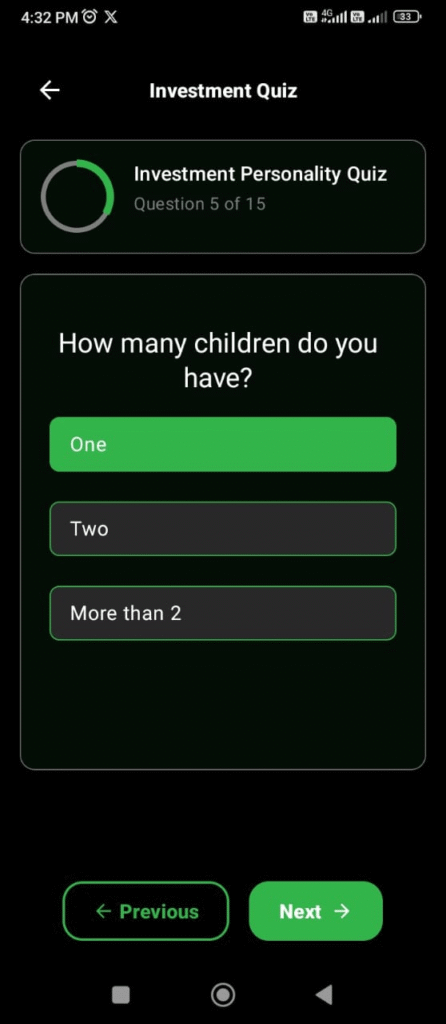

- Step 6: Access the investment Quiz

When asked to select the quantity of your children on a form, you should provide the exact number of children you currently have or are legally your dependents. This number typically refers to living children who are part of your household or for whom you have parental responsibilities.

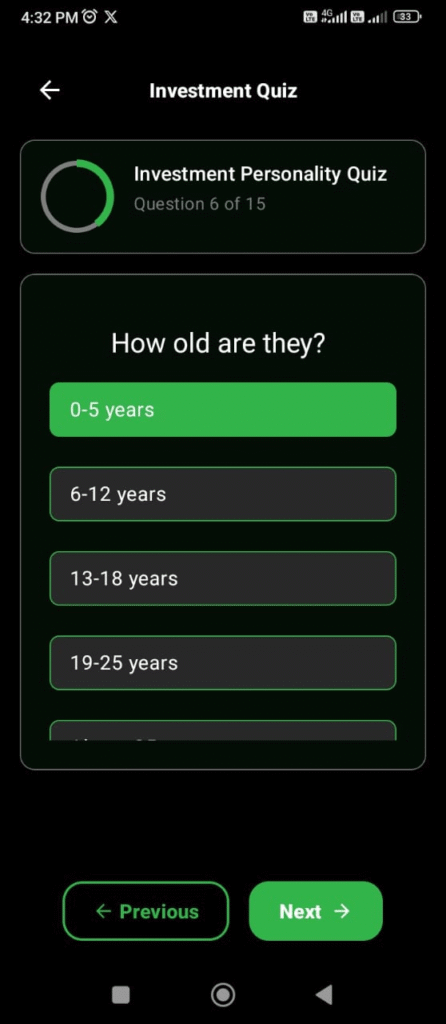

- Step7: Access the investment Quiz

When asked to select or enter your child’s age on a form, the common approach is:

If the form has separate fields for each child’s age, enter the age accordingly for each individual child.

- For children under 2 years old, specify their age in months (e.g., 8 months, 18 months).

- For children older than 2 years, enter their age in years (e.g., 3 years, 7 years).

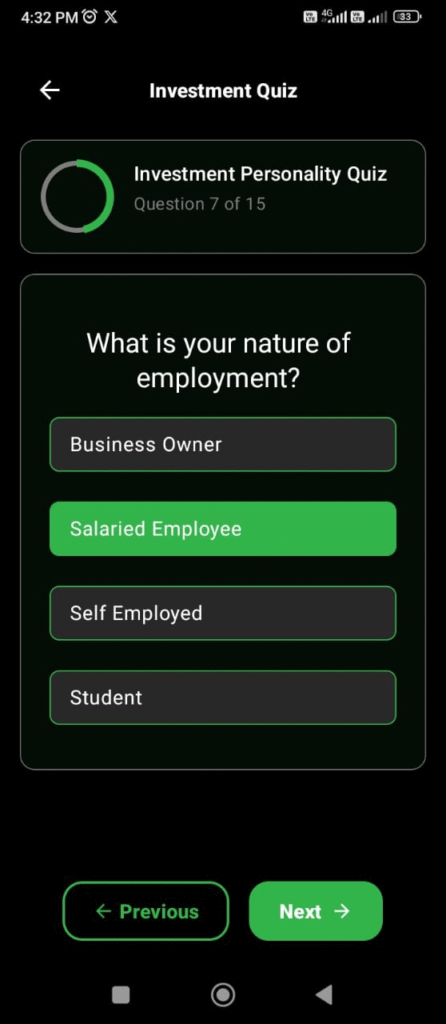

- Step 8: Access the investment Quiz

When asked to select your employment nature, common categories to choose from include:

- Government employee: Working for central or state government bodies.

- Full-time employment: Working typically 35-40 hours per week with long-term job security and benefits.

- Part-time employment: Working fewer hours than full-time, often paid hourly, with fewer benefits.

- Temporary employment: Short-term or project-based work, often to cover specific periods or tasks.

- Contractual or freelance: Working independently based on a contract, not on company payroll, with flexible schedules.

- Seasonal employment: Jobs tied to specific seasons or peak periods, usually temporary.

- Self-employed or entrepreneur: Running your own business or working independently.

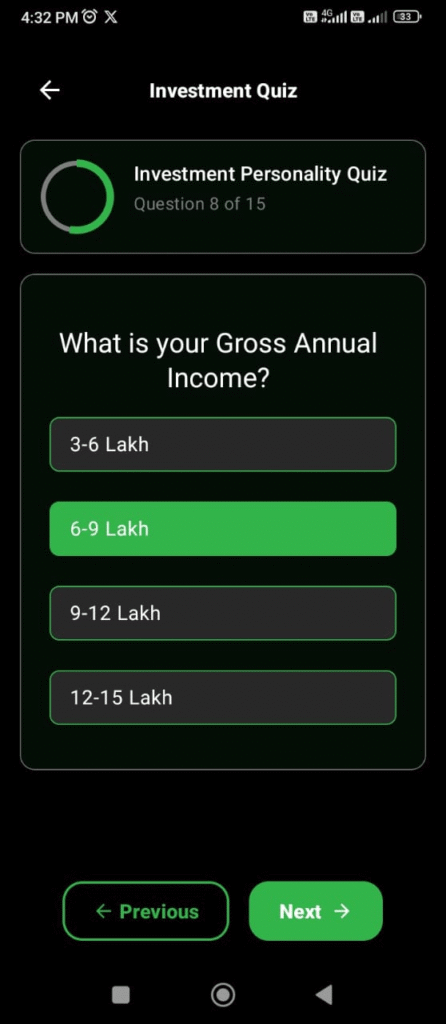

- Step 9: Access the investment Quiz

Select your Gross Anual Income. Gross Annual Income means the total amount of money you earn in one year before any taxes or other deductions are taken out. It includes all sources of income such as your salary or wages, bonuses, commissions, overtime pay, rental income, dividends from investments, and any other earnings before deductions. This figure gives a broad view of your total earning capacity over a year and is often used for tax calculations, loan applications, and financial assessments.

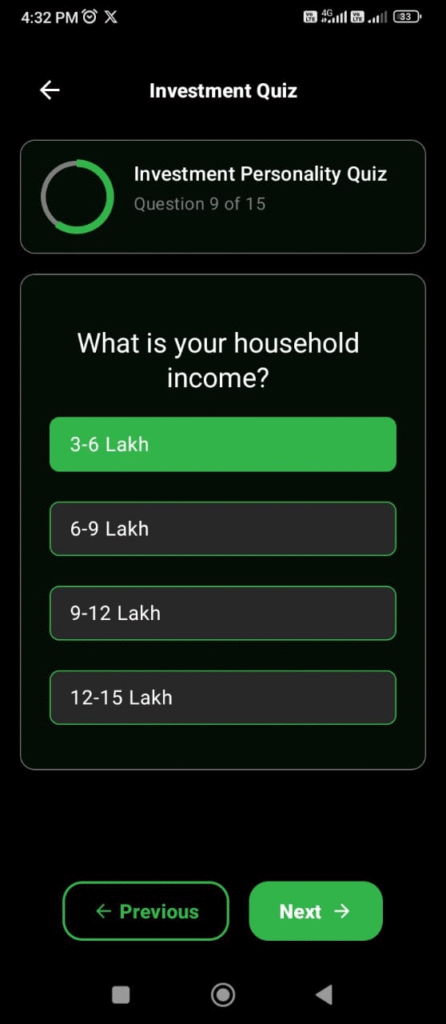

- Step 10: Access the investment Quiz

Select your Household Income,Household income means the total amount of money earned by all members of a household within a year. It includes wages, salaries, and other sources of income such as investments, rental income, Social Security benefits, pension payments, and any other transfer payments received over that period.

- Step 11: Access the investment Quiz

When selecting the product you currently invest in, here is a brief overview of typical investment product categories:

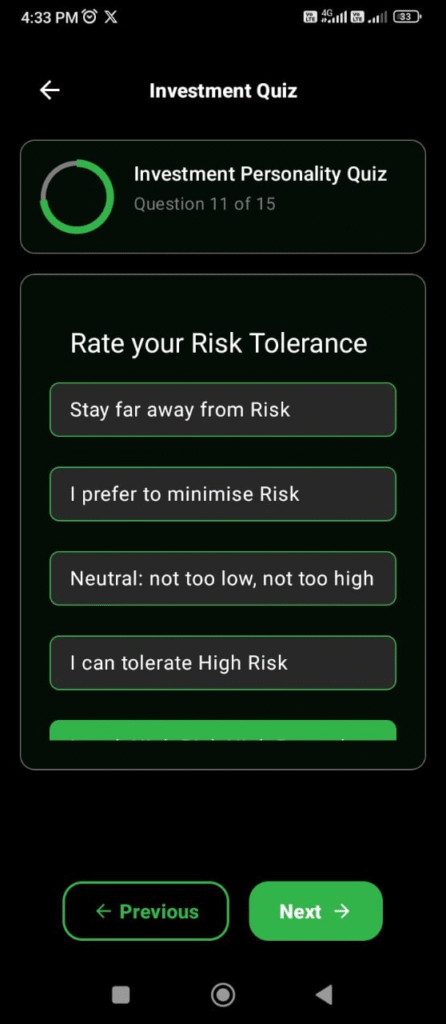

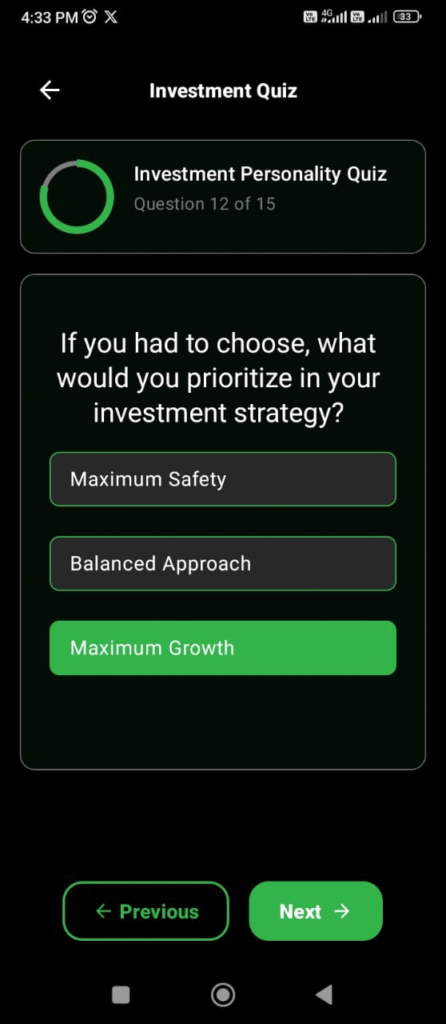

- Step 12: Access the investment Quiz

To rate your risk tolerance, consider how comfortable you are with potential fluctuations in the value of your investments and how much loss you can tolerate in pursuit of returns.

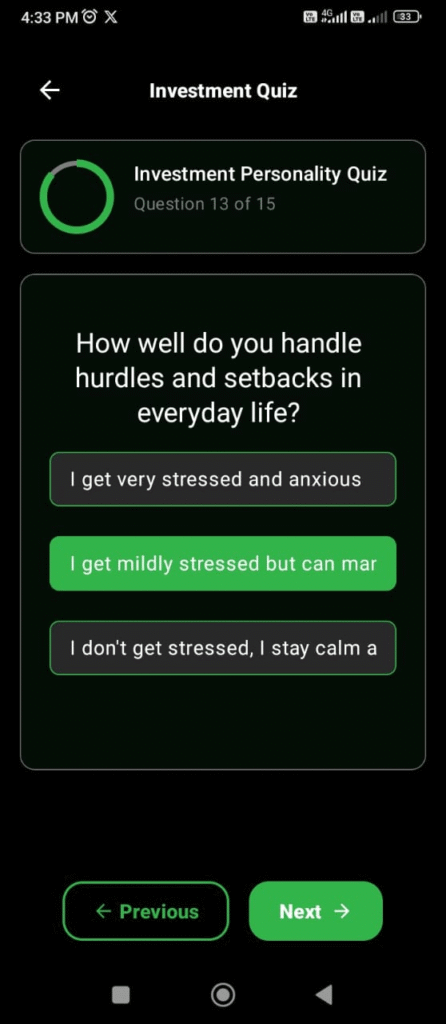

- Step 13: Access the investment Quiz

Choosing “Maximum Growth” indicates a high risk tolerance and a preference for investments with the potential for higher returns, even if they come with significant market fluctuations and possible short-term losses. This strategy typically involves investing more heavily in equities and growth assets, aiming for the long-term appreciation of your portfolio.

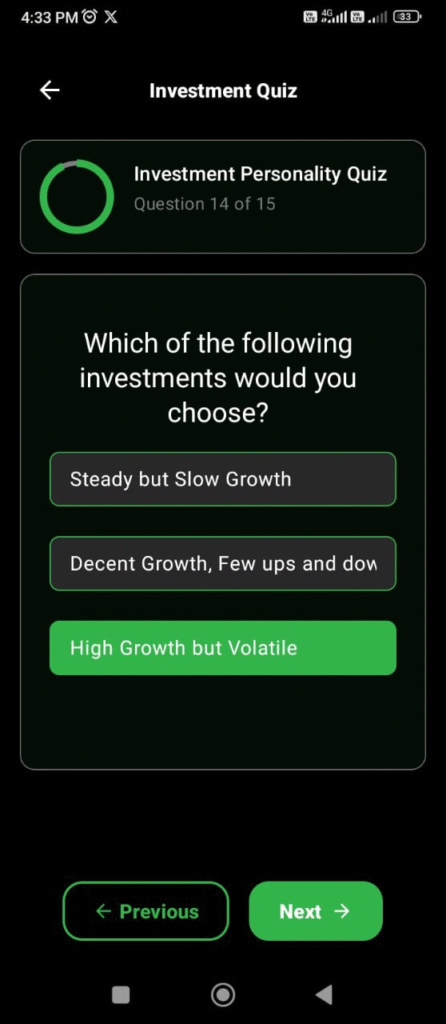

- Step 14: Access the investment Quiz

The selected option is “I get mildly stressed but can manage,” which is highlighted in green.

This response suggests that you have a moderate ability to cope with challenges. It implies you experience some stress during difficulties but are generally able to manage and continue functioning effectively. In terms of risk tolerance, this indicates a balanced approach: you are resilient enough to handle moderate setbacks, which supports a strategy that accepts some risk but not extremes.

- Step 15: Access the investment Quiz

The selected option, highlighted in green, is “High Growth but Volatile.”

This choice demonstrates a strong preference for investments that offer the potential for high returns, even if it means accepting significant volatility and risk. It indicates a higher risk tolerance, as you are willing to handle the fluctuations in value that typically come with growth-focused assets like stocks and certain mutual funds. Such an approach is well-suited for investors seeking substantial long-term gains and who can withstand market ups and downs.

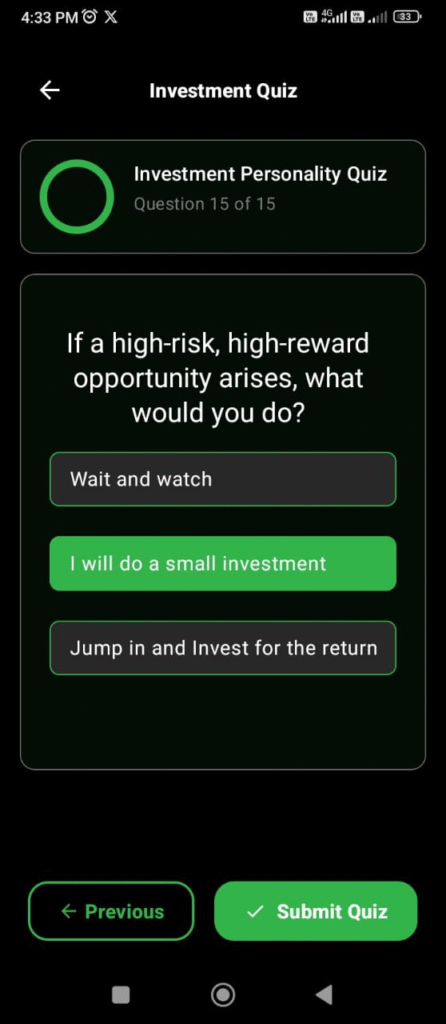

- Step 16: Access the investment Quiz

Now, let’s explore your reaction to new opportunities. Imagine a scenario: A high-risk, high-reward opportunity arises. It could be a new tech stock, a crypto asset, or a venture fund. What would your gut reaction be?

- Step 17: Access the investment Quiz

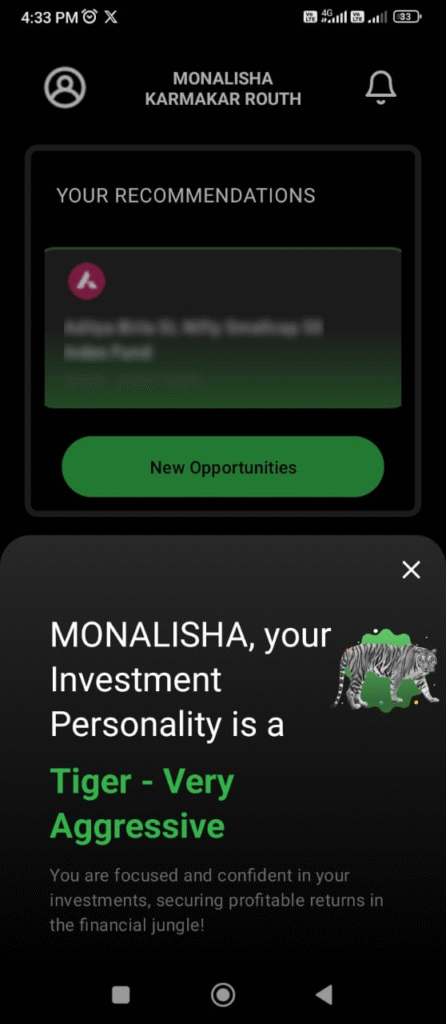

Congratulations, Monalisha! Your investment personality has been revealed. You are The Tiger – a Very Aggressive investor.

This is a powerful and focused profile. It means you have the confidence and risk appetite to pursue significant growth for your financial goals

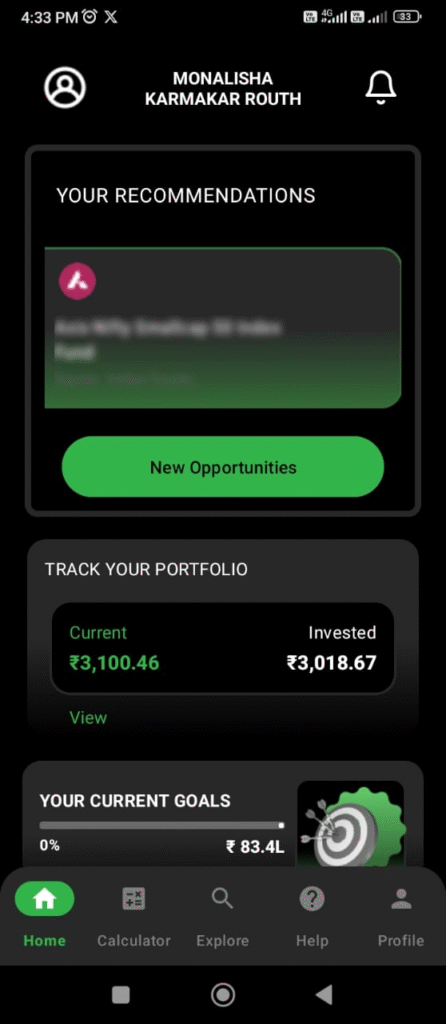

Fund Recommendations on Sanchay Karo Mutual fund Investment App

Sanchay Karo is India’s No. 1 AI-based mutual fund recommendation platform designed to help you invest wisely according to your unique risk profile. Our intelligent AI-driven system analyzes your risk tolerance, financial goals, and investment horizon to instantly recommend the best mutual funds tailored just for you. Whether you are a cautious investor seeking low-risk stability or an aggressive investor aiming for long-term growth, Sanchay Karo ensures your portfolio is perfectly aligned with your comfort level and objectives.

Our platform removes the complexity and confusion of choosing from hundreds of mutual funds by providing personalized, goal-based investment plans. You can plan investments for various goals such as buying a home, funding your child’s education, or retirement planning with clear, actionable recommendations. The simple, user-friendly dashboard tracks your portfolio performance, sends smart SIP reminders, and keeps you on course towards your financial milestones.

With Sanchay Karo, investing becomes stress-free, transparent, and safe through SEBI-compliant channels. Trusted by thousands of investors across India, it is the perfect companion for both beginners and seasoned investors to build wealth the smart way. Start your investment journey today with Sanchay Karo and discover personalized fund recommendations based on your risk profile, powered by cutting-edge AI technology.

Download now to experience hassle-free, tailored mutual fund investing.

Sanchay Karo – Your trusted AI guide to smart, goal-based mutual fund investing in India.