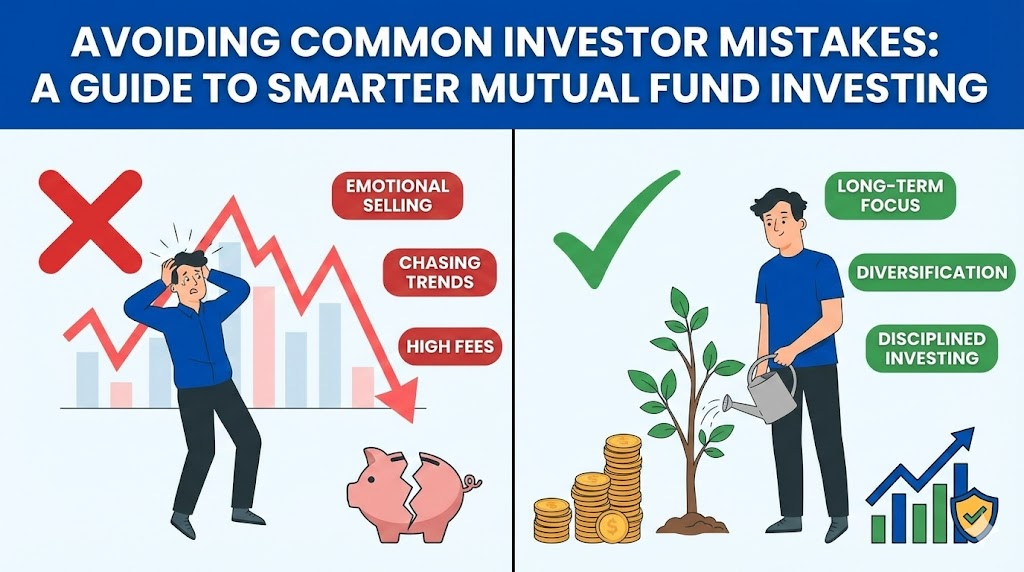

Every investor makes mistakes—it’s part of the journey. But learning from them is what separates successful investors from those who struggle. In my years of guiding mutual fund investors, I’ve seen the same errors repeated time and again. The good news? Each one is avoidable with awareness and discipline.

Chasing Past Returns

One of the most common—and costly—mistakes is chasing last year’s top performers. A fund delivering 30% returns one year may underperform the next. Past performance doesn’t guarantee future results—it’s written in every mutual fund document for a reason.

Instead of chasing returns, look for:

- Consistent performance across market cycles

- Experienced fund management

- Clear investment strategy

- Alignment with your goals

Think of it like hiring someone based on their entire career, not just one good year.

Trying to Time the Market

“Is now the right time to invest?” If I had a rupee for every time I’ve heard this question… The truth? Even professionals struggle with market timing. Time in the market beats timing the market.

SIPs are your secret weapon here—they automate investing, remove emotion, and benefit from rupee-cost averaging. The best time to start was yesterday. The second-best time is today.

Reacting to Market Noise

News headlines scream about crashes, inflation, and global crises daily. Most of this is noise that triggers emotional decisions: redeeming during corrections, switching funds based on fear, or stopping SIPs prematurely.

Stay focused on your plan, not the news. Your investments are for your future, not for reacting to daily headlines.

Ignoring Asset Allocation

How you divide your money between equity, debt, and other assets is crucial for long-term success. Yet many investors either go all-in on equities or scatter investments randomly.

Your asset allocation should reflect:

- Your financial goals

- Time horizon

- Risk tolerance

Review and rebalance annually—it’s like steering a ship to stay on course.

Over-Diversifying or Under-Diversifying

Too many funds: Creates overlap and becomes unmanageable

Too few funds: Concentrates risk

The sweet spot? 5-7 well-chosen funds across different categories—enough to diversify but not so many that you lose track.

Skipping Regular Reviews

Investing isn’t a set-it-and-forget-it activity. Review your portfolio at least once a year to:

- Check fund performance against benchmarks

- Ensure alignment with your goals

- Rebalance if needed

A neglected portfolio can drift far from its intended destination.

Letting Emotions Drive Decisions

Fear and greed are the twin enemies of investing. Fear causes panic selling during downturns. Greed leads to chasing risky bets.

Combat emotions with:

- A written investment plan

- A 24-hour cooling-off period before major decisions

- Regular consultations with a trusted advisor

Investing Without Clear Goals

Without purpose, every market dip feels like a failure. Goal-based investing provides direction and resilience.

Write down specific goals with amounts and timelines. Link each mutual fund investment to a purpose—whether it’s your child’s education, retirement, or a dream home.

Poor Documentation and Lack of Family Awareness

Many investors maintain poor records, and their families remain unaware of investments. This creates unnecessary stress during emergencies.

Create a simple investment summary including:

- Fund names and folio numbers

- Login credentials

- Nominee details

- Advisor contact information

Share this with trusted family members.

Falling for Mis-Selling

Not all financial advice serves your interests. Be wary of:

- Products pushed with urgency

- Promises of guaranteed high returns

- Complex products you don’t understand

Always ask: “Is this suitable for my goals?” not just “What returns will I get?”

Procrastinating Your Start

Delaying investing is the most expensive mistake of all. Thanks to compounding, starting early matters more than investing large amounts.

🌱 Start Small, Start Now

Don’t wait for the “perfect” moment or a large sum. Begin your investment journey with amounts as low as ₹100 and let compounding work its magic.

📲 Download the Sanchay Karo App to Begin:

Android | Apple

Your Investor Mistake-Avoidance Checklist:

- I don’t chase past performance; I look for consistency

- I invest regularly via SIPs instead of timing the market

- I ignore daily market noise and focus on my plan

- My asset allocation matches my goals and risk tolerance

- I maintain 5-7 well-chosen funds, not 20+

- I review my portfolio at least annually

- I have a written investment plan to counter emotions

- Every investment links to a specific financial goal

- I maintain proper documentation and have informed my family

- I verify that recommended products suit my needs

- I’ve started investing—no more procrastination

Investing success isn’t about never making mistakes—it’s about learning, adjusting, and staying disciplined. Mutual funds are powerful tools, but their effectiveness depends entirely on the investor’s behavior. Avoid these common pitfalls, and you’re already ahead of most investors.

Inspired by “The Mutual Fund Way” by Sanchay Karo .

✔ Invest Wisely | ✔ Avoid Pitfalls | ✔ Build Wealth Confidently