The Indian economy is currently experiencing a dynamic phase of growth, resilience, and modernization. At the very heart of this transformative journey lies one critical sector that acts as the circulatory system for the entire nation: Banking and Financial Services (BFSI).

If you have been looking for an opportunity to align your investment portfolio with the core drivers of India’s economic expansion, we have some exceptionally exciting news for you.

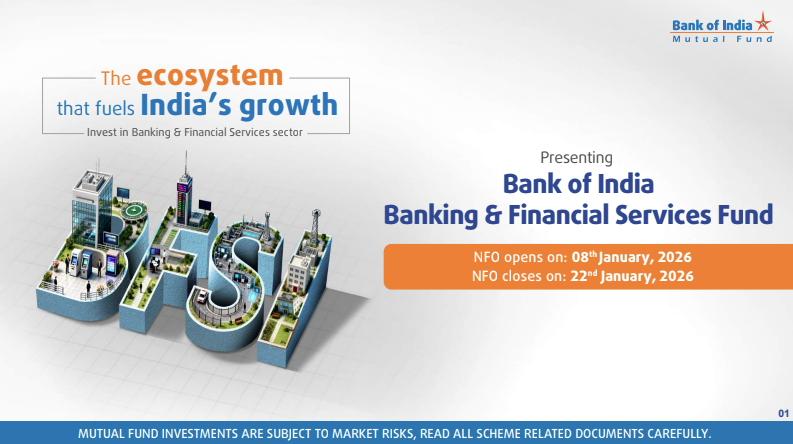

We are thrilled to announce the launch of a new investment avenue designed to capture the potential of this vital sector: The Bank of India Banking & Financial Services Fund.

The New Fund Offer (NFO) for this scheme opens for subscription on Thursday, 8th January 2026.

This blog post will dive deep into why the banking and financial services sector is currently at a pivotal point, what this new fund offers, and how you can participate in this new offering through the Sanchay Karo app.

The Pulse of a Rising Economy: Why Banking & Financial Services Now?

To understand the potential of this new fund, we must first look at the macroscopic picture of India today. The nation is marching steadily towards becoming a globally dominant economic power. This journey requires massive capital, efficient credit flow, robust risk management, and widespread financial inclusion.

Who facilitates this? The Banking and Financial Services sector.

Historically, the performance of the BFSI sector has been closely correlated with the GDP growth of the country. When the economy expands, businesses need loans to grow, individuals seek credit for homes and cars, insurance penetration deepens, and investment activity rises.

Here is why the sector looks compelling right now:

1. The Credit Growth Supercycle

After years of cleaning up balance sheets, corporate India is deleveraged and ready to spend on capital expenditure (Capex). Simultaneously, retail consumption is booming. This dual demand is fueling a robust credit growth cycle. Banks, both public and private, are well-capitalized and in a strong position to lend, driving their own profitability.

2. Beyond Traditional Banking: The Financialization of Savings

The Indian saver is evolving. There is a distinct shift happening from traditional physical assets (like gold and real estate) to financial assets (like mutual funds, stocks, and insurance). This trend benefits not just banks, but also asset management companies, wealth managers, and stock exchanges—all of which fall under the umbrella of “Financial Services.”

3. The Fintech Revolution and Digital Public Infrastructure

India’s success story with UPI (Unified Payments Interface) is globally recognized. But it’s not just about payments. Technology is lowering the cost of customer acquisition for lenders, enabling micro-insurance, and democratizing access to investments. Fintech companies and tech-savvy incumbent banks are opening up entirely new markets that were previously inaccessible.

4. Underrated Sub-Sectors

The BFSI sector is vast. It isn’t just about large commercial banks. It includes:

- NBFCs (Non-Banking Financial Companies): Crucial for last-mile lending and specialized finance.

- Insurance: India remains vastly underinsured in both life and general (health/motor) segments, offering immense headroom for growth.

- Capital Market Players: Rating agencies, exchanges, and brokerages that thrive as market participation increases.

Introducing the Bank of India Banking & Financial Services Fund

The Bank of India Banking & Financial Services Fund is an open-ended equity scheme dedicated to investing in the Banking and Financial Services sector.

The Objective: The primary objective of the scheme is to generate long-term capital appreciation by investing predominantly in equity and equity-related securities of companies engaged in banking and financial services activity.

The Strategy: This is a Sectoral Fund. This means its mandate is to focus its investments specifically within this part of the economy. The fund manager will curate a portfolio of high-potential companies across the spectrum mentioned above—private banks, PSUs, leading NBFCs, insurance giants, and emerging fintech players.

By investing in this NFO, you are essentially taking a diversified bet on the continued formalization and financial growth of India.

Important NFO Dates to Remember

If you are ready to add a focused growth engine to your portfolio, mark these dates on your calendar for January 2026.

- NFO Opening Date: 08/01/2026 (Thursday)

- NFO Closing Date: 22/01/2026 (Friday)

- NFO Allotment Date: 30/01/2026 (Friday)

- Scheme Reopening Date: 02/02/2026 (Monday)

During the NFO period, you have the opportunity to invest at the initial unit price, typically ₹10.

Who Should Invest in This Fund?

While the potential of the BFSI sector is undeniable, it is crucial to align any investment with your personal risk profile and financial goals.

Sectoral funds, by definition, carry higher risk compared to diversified equity funds (like Flexi-cap or Large-cap funds). Because the fund’s performance is tied to a single sector, it can face higher volatility if that specific sector faces headwinds (e.g., regulatory changes or economic slowdowns).

Therefore, the Bank of India Banking & Financial Services Fund is ideally suited for:

- Investors with a High-Risk Appetite: You should be comfortable with short-term market volatility in exchange for potential long-term gains.

- Long-Term Investment Horizon: This is not a short-term play. Ideally, investors should have a horizon of 5 years or more to allow the sectoral themes to play out fully.

- Seeking Satellite Allocation: For a well-balanced portfolio, this fund can serve as a “satellite” holding—a tactical allocation meant to boost overall returns, complementing your core diversified holdings.

How to Invest via Sanchay Karo

We want to ensure your participation in this NFO is smooth and hassle-free. You can invest in the Bank of India Banking & Financial Services Fund NFO directly through our Sanchay Karo platform.

Sanchay Karo makes managing your investments simple, secure, and quick.

Download the app today to get KYC ready before the NFO opens:

👉 For Android Users: Download Sanchay Karo on Play Store

👉 For Apple Users: Download Sanchay Karo on App Store

🌐 Visit our Website: www.sanchyakro.com

Don’t miss the chance to participate in India’s financial growth story from the ground floor. Get ready for the 8th of January!

Disclaimer: Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. This blog post is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions to ensure the product is suitable for their needs.