⛽ Give Your Fuel Spends Some Extra Mileage with the BPCL SBI Credit Card!

Fuel prices may rise and fall, but your savings don’t have to take a hit every time you refuel. With the BPCL SBI Credit Card, every visit to the petrol pump becomes an opportunity to earn rewards, enjoy cashback, and save money—without changing your routine.

Whether you drive daily to work, travel frequently by car, or simply want to make the most of your fuel expenses, this card is designed to reward your lifestyle.

👉 Apply Now for the BPCL SBI Credit Card

📞 Need help? Call: 7278480128

📲 Join Our WhatsApp Channel

🌐 Visit: www.sanchaykaro.com

🚗 Why Choose the BPCL SBI Credit Card?

The BPCL SBI Credit Card is specially crafted for individuals who spend regularly on fuel and are looking to turn their daily costs into valuable rewards. This is more than just a credit card—it’s your key to extra savings on essentials.

Here’s a quick look at the major benefits:

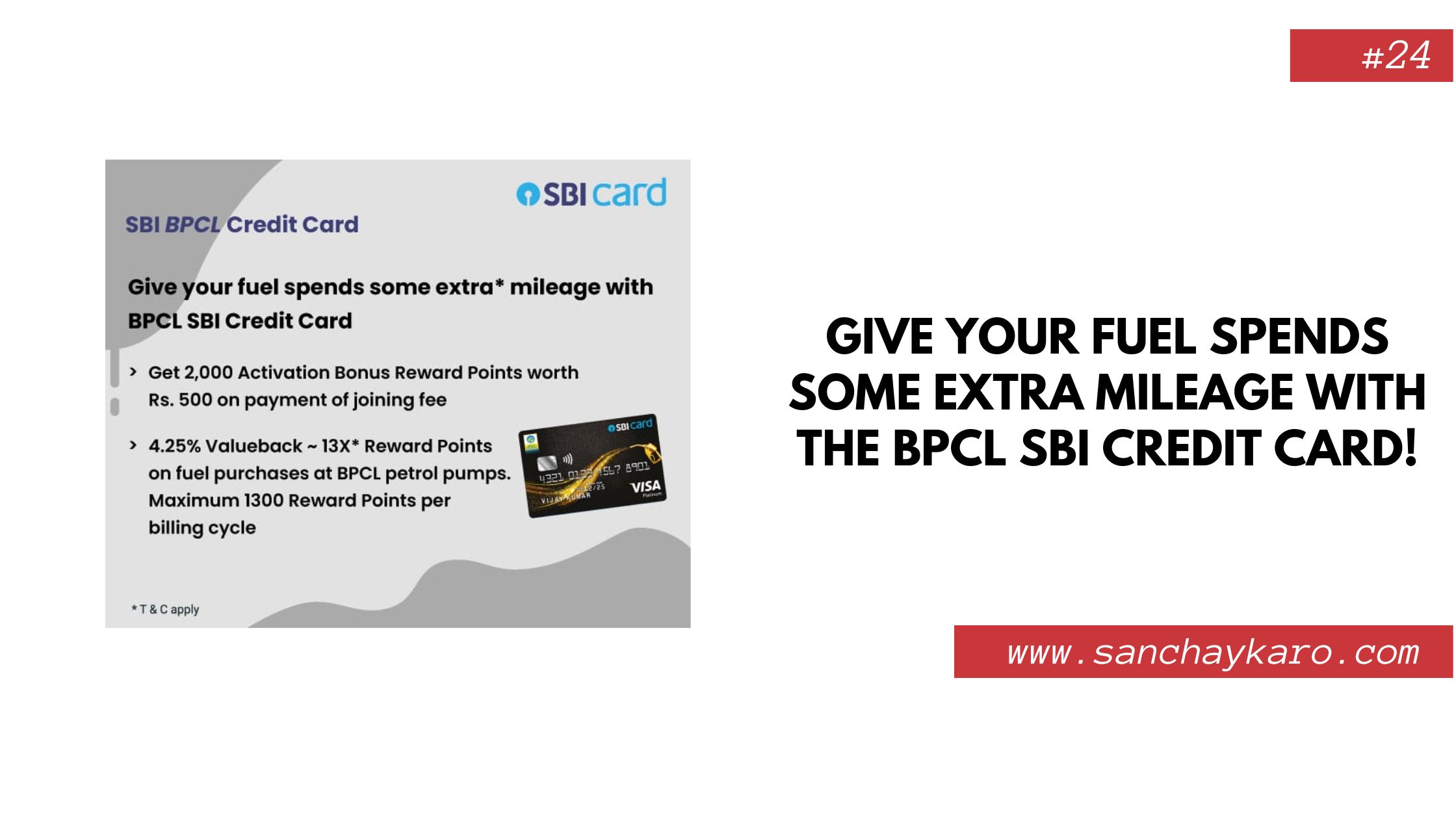

✅ 2,000 Bonus Reward Points on Joining

Kickstart your journey with 2,000 reward points (worth ₹500) just for joining. That’s a welcome gift you can actually use.

✅ 4.25% Value Back on Fuel Spends

When you use this card at Bharat Petroleum petrol pumps, you get:

- 13X reward points per ₹100 spent on fuel

- Equivalent to 4.25% savings on fuel transactions

✅ Fuel Surcharge Waiver

Why pay extra? With the BPCL SBI Card, you get:

- 1% fuel surcharge waiver at BPCL outlets

- Valid on transactions between ₹500 and ₹4,000

✅ 5X Rewards on Everyday Spending

Your savings don’t stop at fuel. Enjoy 5X reward points on:

- Groceries

- Dining

- Departmental store purchases

You earn while you eat, shop, and live your daily life.

✅ Contactless Convenience

The card supports contactless payments, making transactions quicker and safer.

🔍 A Real-World Example of Your Savings

Let’s say you spend:

- ₹5,000/month on fuel

- ₹2,500/month on groceries

- ₹2,000/month dining out

With the BPCL SBI Card, here’s what you’d get:

- ₹212.50 savings on fuel (4.25%)

- 5X rewards on groceries & dining (~450 reward points)

- Plus 2,000 bonus points on sign-up

That’s real, tangible value—month after month!

💡 Why Apply from This Link?

There are many ways to apply for a credit card, but not all routes offer speed, transparency, or ease. Here’s why you should apply through us:

✔️ 100% Online Process

No need to visit a bank or branch. The application process is fully digital, secure, and mobile-friendly.

✔️ Minimal Documentation

Just a few basic documents like PAN, Aadhaar, and income proof—and you’re ready to go. No lengthy paperwork or unnecessary hassles.

✔️ Fast Approval

Most applicants receive instant approval decisions, and the card is dispatched within a few working days.

🏦 Eligibility Criteria

Worried about whether you’ll qualify? Don’t be. The eligibility is simple:

- Age: 21–65 years

- Income: ₹20,000+ monthly (salary or self-employed)

- KYC: PAN, Aadhaar, Address Proof

- Credit Score: A basic score (650+) is recommended, but even new-to-credit applicants can apply

📑 Required Documents

Here’s what you’ll need during the application process:

- PAN Card

- Aadhaar Card

- Latest salary slip / ITR / bank statement

- Passport-size photo (digital copy)

That’s it! No physical visits, no long queues.

🧠 Pro Tips: How to Maximize Benefits

Once you get your card, here’s how you can maximize its value:

- Refuel at BPCL only – to earn the maximum 13X reward points

- Convert big purchases into EMIs if needed—SBI Cards offers flexible EMI options

- Pay your dues in full each month to avoid interest

- Track your reward points regularly and redeem them via the SBI Card portal

- Use the card for grocery and dining spends to earn accelerated rewards

💬 What Our Users Say

“I used to pay for fuel with cash—what a waste! After switching to the BPCL SBI Card, I save around ₹250–₹300/month easily.”

– Suresh P., Mumbai

“The online application was simple and quick. Got my virtual card in 48 hours and started saving immediately.”

– Riya G., Kolkata

“I love the 5X rewards on groceries and restaurants. I get rewarded for my routine expenses—what more could I ask for?”

– Harsh V., Bangalore

🔐 Safe, Secure, and Backed by SBI

This card is issued by SBI Card, one of India’s most trusted names in financial services. With top-tier security protocols, easy access to your account via the SBI Card app, and 24/7 customer support, you’re in good hands.

Plus, your card comes with:

- Fraud protection coverage

- SMS and email alerts

- PIN-based & contactless security

🤔 Still Have Questions?

No worries—we’re here to help.

📞 Call us directly at 7278480128 for guidance

📩 Or message us via our WhatsApp Channel for quick support, updates, and tips

🎯 Final Thoughts: The Card That Fuels Your Life

If you’re already spending money on fuel, food, and groceries, why not get rewarded for it?

With the BPCL SBI Credit Card, you’re not just saving money—you’re unlocking a better, more rewarding way to spend.

✔️ Up to 4.25% savings on fuel

✔️ 5X rewards on daily expenses

✔️ Easy online application

✔️ Minimal documents

✔️ Backed by SBI’s trusted service

Don’t miss out on India’s most fuel-efficient credit card—financially and functionally.

👉 Apply for the BPCL SBI Credit Card Now

🔗 Useful Links

- 🌐 More financial tools: www.sanchaykaro.com

- 📲 Join WhatsApp Channel for updates, offers, and investing tips

- 📞 Call us at 7278480128 for personal assistance

Sanchay Karo – Helping You Save More, Spend Smart, and Grow Your Wealth Wisely.

#BPCLSBICreditCard #FuelSavings #RewardCard #ApplyOnline #SanchayKaro #CreditCardIndia #FuelWaiver #SBIcard