Our Story

How Sanchay Karo began its journey to transform investing in India

From Complexity to Simplicity

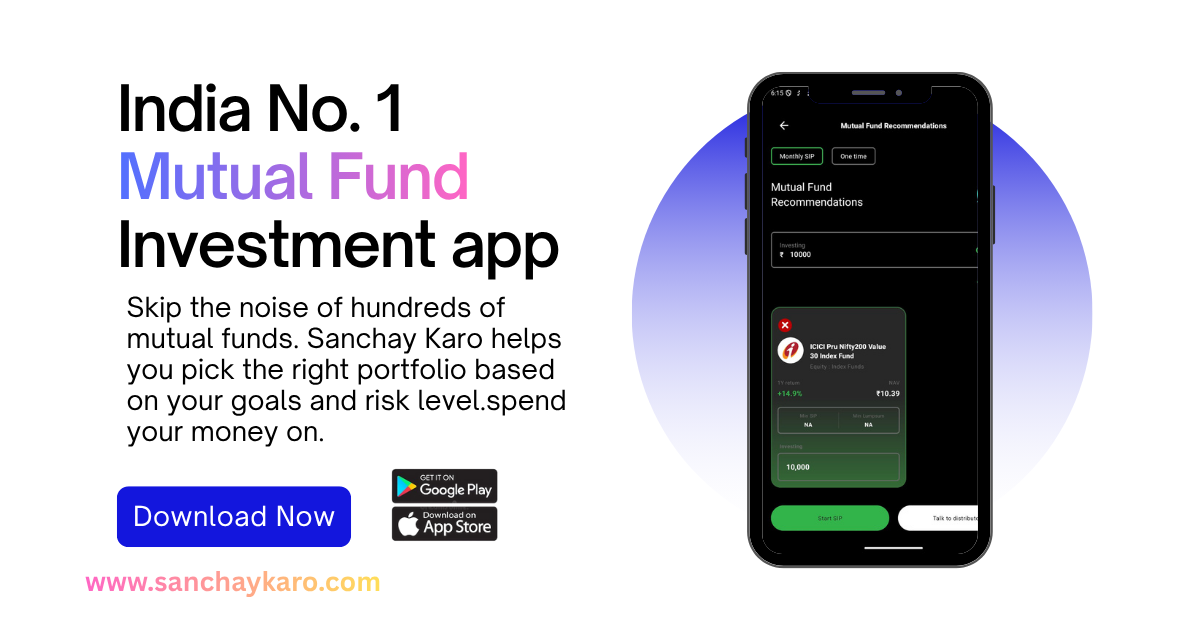

Sanchay Karo was founded in 2023 by a team of financial experts and technology enthusiasts who saw the same problem everywhere—investing had become confusing, scattered, and overwhelming for most Indians. They believed wealth-building shouldn’t feel complicated or intimidating.

With hundreds of mutual funds, complex terminology, and too much information floating around, most people felt lost. Many avoided investing altogether, while others ended up choosing the wrong funds due to lack of proper guidance. Sanchay Karo was created to cut through this noise.

We set out to build a platform that makes investing simple, guided, and stress-free—from fund discovery to execution to tracking. Sanchay Karo helps you build long-term wealth without complications. Whether you’re new to investing or planning for a major goal, the platform keeps everything smooth and easy with:

➦Smart Fund Suggestions – Answer a few questions and instantly get a portfolio tailored to your goals and risk profile.

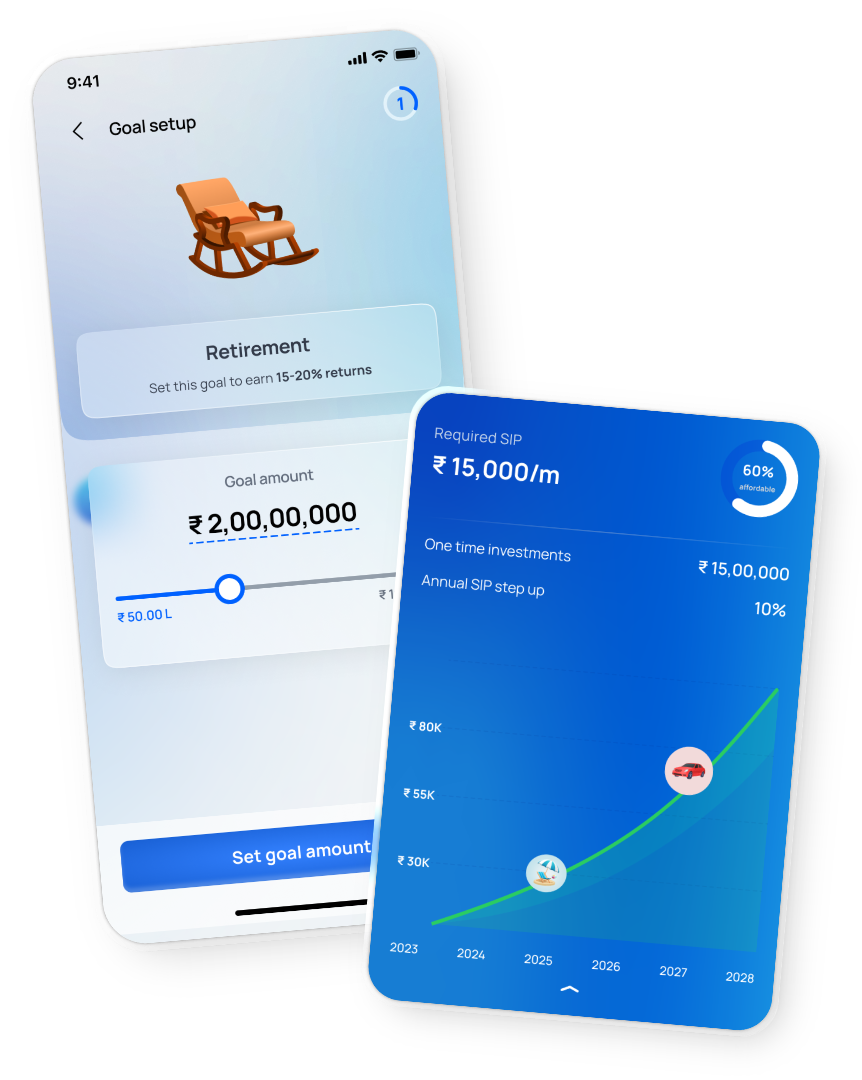

➦Goal-Based Investing – Plan for a home, education, retirement, or any milestone with clarity and confidence.

➦Simple Portfolio Tracking – Clean summaries and insights without confusing charts or jargon.

➦Stay On Track Alerts – Timely reminders to keep your SIPs running and goals progressing.

➦Expert-Backed Approach – Designed using proven investment frameworks and secure technology.

➦SEBI-Compliant & Secure – Invest safely through trusted, registered platforms and leading fund houses.

Today, Sanchay Karo is helping thousands of Indians build wealth systematically and confidently. With personalized portfolios, goal-based planning, and continuous guidance, we’re making smart investing accessible for everyone—one step at a time.