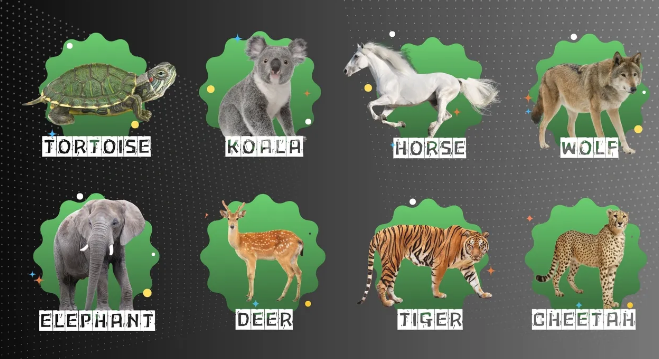

Welcome to SanchayKaro! We believe your investments should be as unique as you are. Instead of a boring form, we use a fun, quick quiz to match you with an “Investment Animal” personality. This helps us recommend funds that truly suit your goals and comfort level.

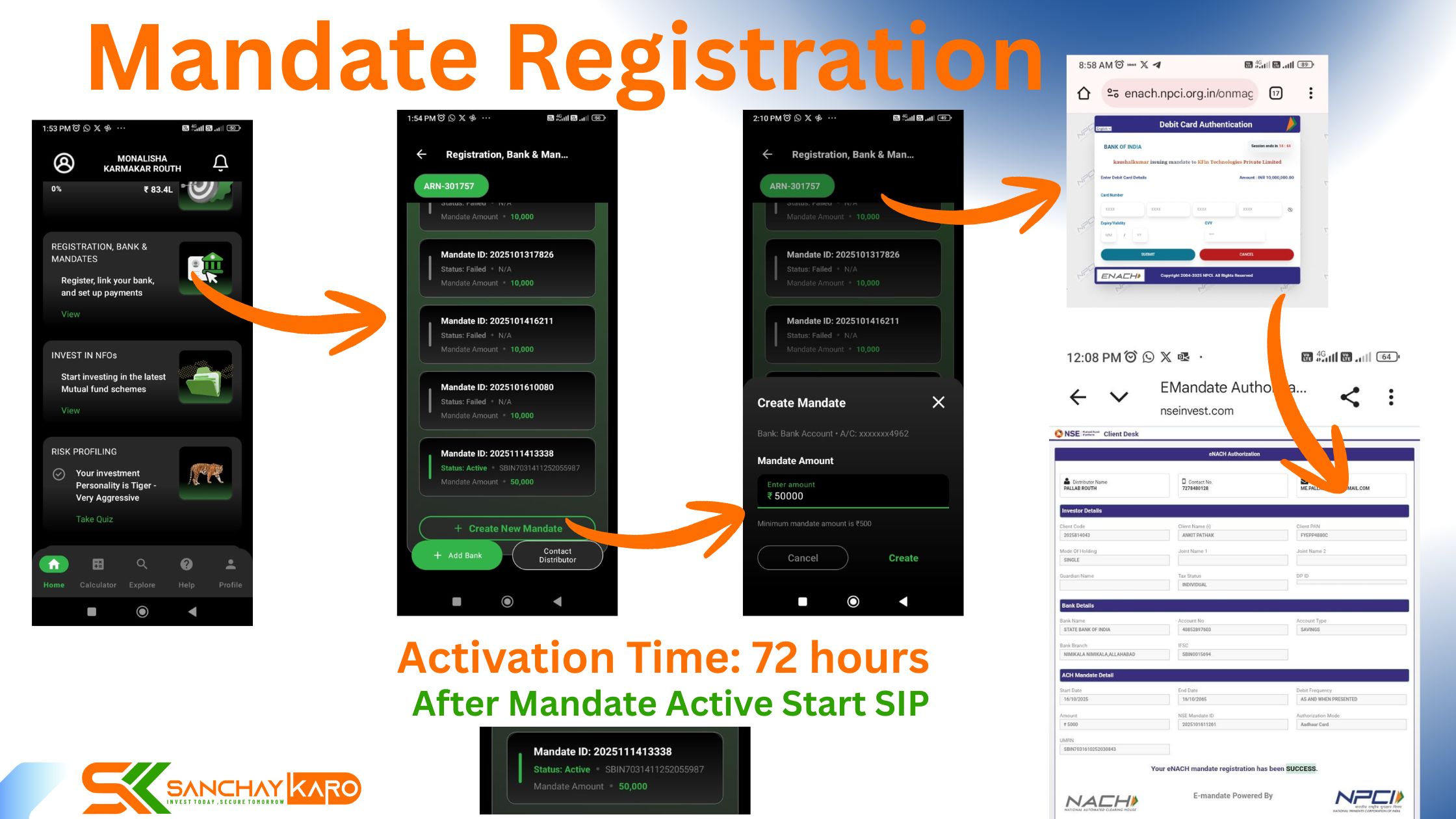

Mandate Registration in Sanchay Karo App

The magic behind this hands-free investing is a simple yet powerful feature called a Mandate. If you’re new to systematic investing, don’t worry. This guide will walk you through everything you need to know about Mandate Registration in Sanchay Karo App in minutes.

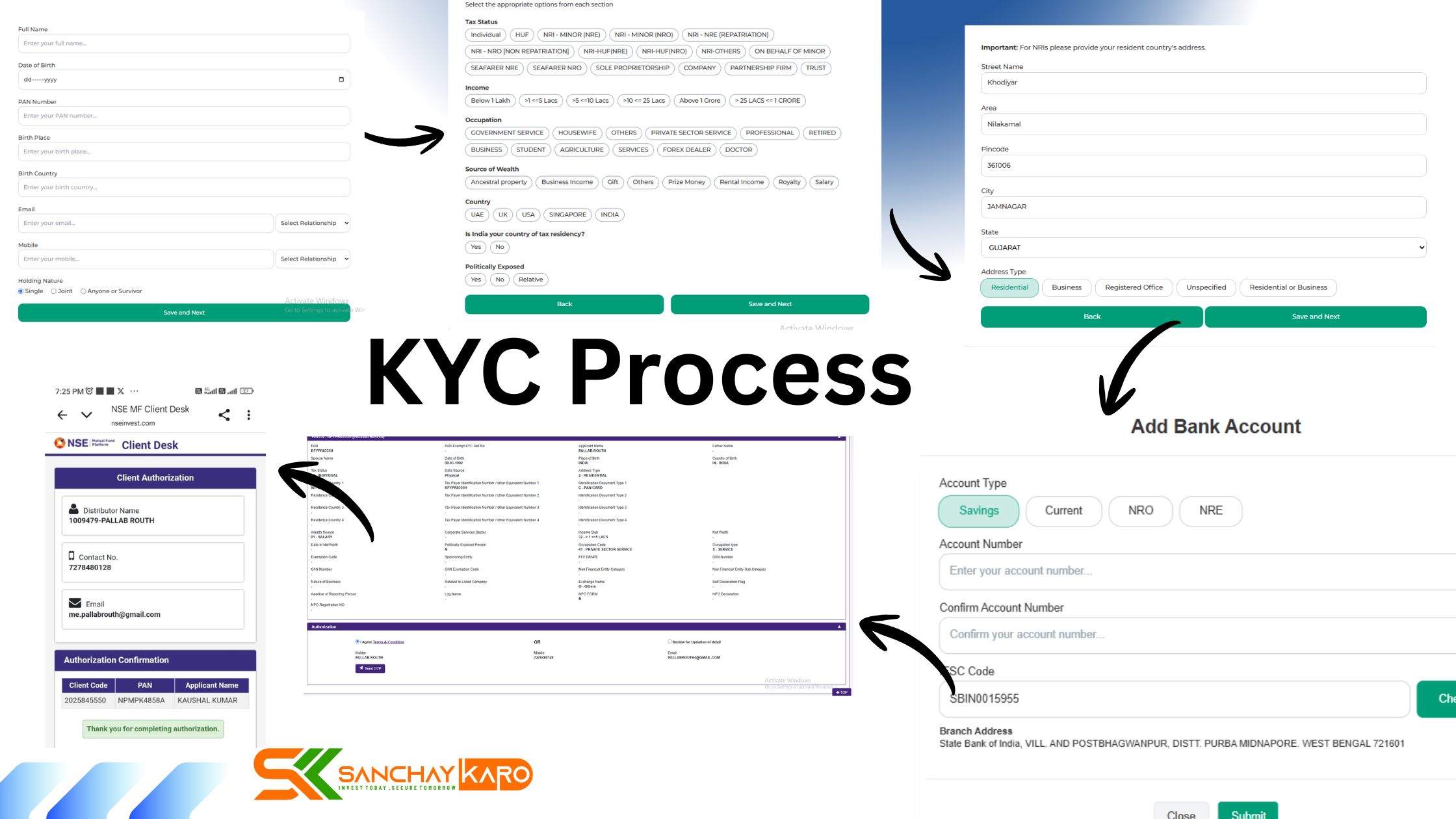

Simplified KYC Process with Sanchay Karo

KYC is a mandatory step by SEBI for all investors in India. It helps us verify your identity and keep your investments safe and secure. We are Integrated With NSE API for Simplified KYC Process with Sanchay Karo useing ARN-301757 owned by Mr. Pallab routh .

Your Dream Goals, Simplified: Plan, Save, and Grow with Sanchay Karo

Welcome to Sanchay Karo – the simple and smart app that helps you plan, save, and grow your money for your future goals.

NPS Vatsalya: Give Your Child a Strong Financial Start With India’s New Pension Scheme for Minors

India’s new NPS Vatsalya scheme, regulated by the Pension Fund Regulatory and Development Authority (PFRDA), is designed specifically for minors to help them start their financial journey from childhood. With an annual investment as low as Rs. 1,000, parents and guardians can introduce their child to responsible saving habits and long-term wealth creation.

💸 SIP vs. Lump Sum: Which Is Right for You?

Confused between SIP and Lump Sum investment? Learn which is right for you. Start your mutual fund journey with Rabbit Invest, powered by Sanchaykaro.com – India’s best investment app.

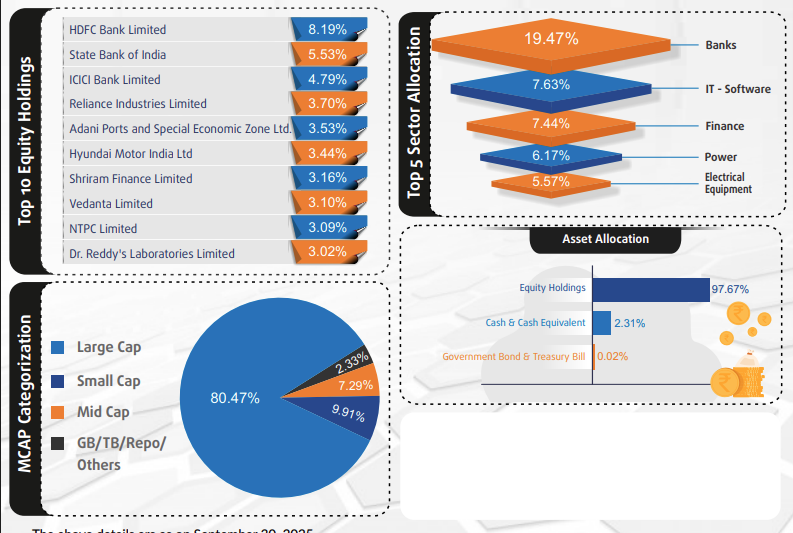

💼 Bank of India Large Cap Fund – Regular Plan (Growth): A Reliable Path to Long-Term Wealth Creation

In the dynamic world of mutual funds, investors often seek a perfect balance between growth potential and stability. For those who wish to invest in companies with strong fundamentals and proven track records, large-cap mutual funds are often the go-to choice. One such fund that stands out in this category is the Bank of India Large Cap Fund – Regular Plan (Growth).

💰 Best ELSS Fund to Invest in 2025: Parag Parikh ELSS Tax Saver Fund

Best ELSS Fund to Invest – When it comes to saving tax and creating long-term wealth, ELSS (Equity Linked Savings Schemes) are one of the smartest investment options available for every investor. Among all, the Parag Parikh ELSS Tax Saver Fund stands out as one of the best-performing ELSS funds to invest in 2025.

BPCL SBI Credit Card

Fuel prices may rise and fall, but your savings don’t have to take a hit every time you refuel. With the BPCL SBI Credit Card, every visit to the petrol pump becomes an opportunity to earn rewards, enjoy cashback, and save money—without changing your routine.

What Happens When You SIP ₹3,000 for 30 Years?

As I briefly step away for a short absence, I wanted to leave you with a powerful insight into one of the most impactful and life-changing financial habits anyone can adopt — investing through a Systematic Investment Plan (SIP).