NFo- The Indian mutual fund industry continues to grow rapidly in 2025, with new players entering the space, strong retail participation, and sectoral shifts shaping investment opportunities. In this article, we’ll cover the latest mutual fund trends, explain key concepts like NAV and asset allocation, and explore ongoing NFOs (New Fund Offers) that you can consider for your portfolio.

HSBC Live plus Credit Card

In today’s fast-paced world, managing finances efficiently is more important than ever. The HSBC Live+ Credit Card offers a perfect blend of rewards, convenience, and exclusive perks, making it an ideal choice for those looking to maximize their spending power. Whether you’re a frequent shopper, a foodie, or someone who enjoys the finer things in life, this card is designed to enhance your lifestyle while keeping your expenses in check.

Simplify Investing with Mutual Funds

For many people, investing can feel confusing, risky, or even intimidating. Stock markets, IPOs, FD rates, inflation — it’s a lot to process. But here’s the good news:

How Much Time Period is Needed to Invest in SIP

How Much Time Period is Needed to Invest in SIP for Better Results?… In today’s fast-paced world, where everyone wants quick returns and instant profits, Systematic Investment Plans (SIPs) bring a breath of fresh air — offering a slow, steady, and reliable route to wealth creation. But one key question that investors often ask is:

SBM ZET Credit Card

In today’s financial landscape, establishing a strong credit score is essential for accessing loans, credit cards, and favorable interest rates. However, for many individuals, building or rebuilding a credit score can be a challenging endeavor. Enter the SBM ZET Credit Card, a revolutionary product designed to help you build a 750+ credit score effortlessly, all while enjoying the convenience of UPI payments and a host of other benefits.

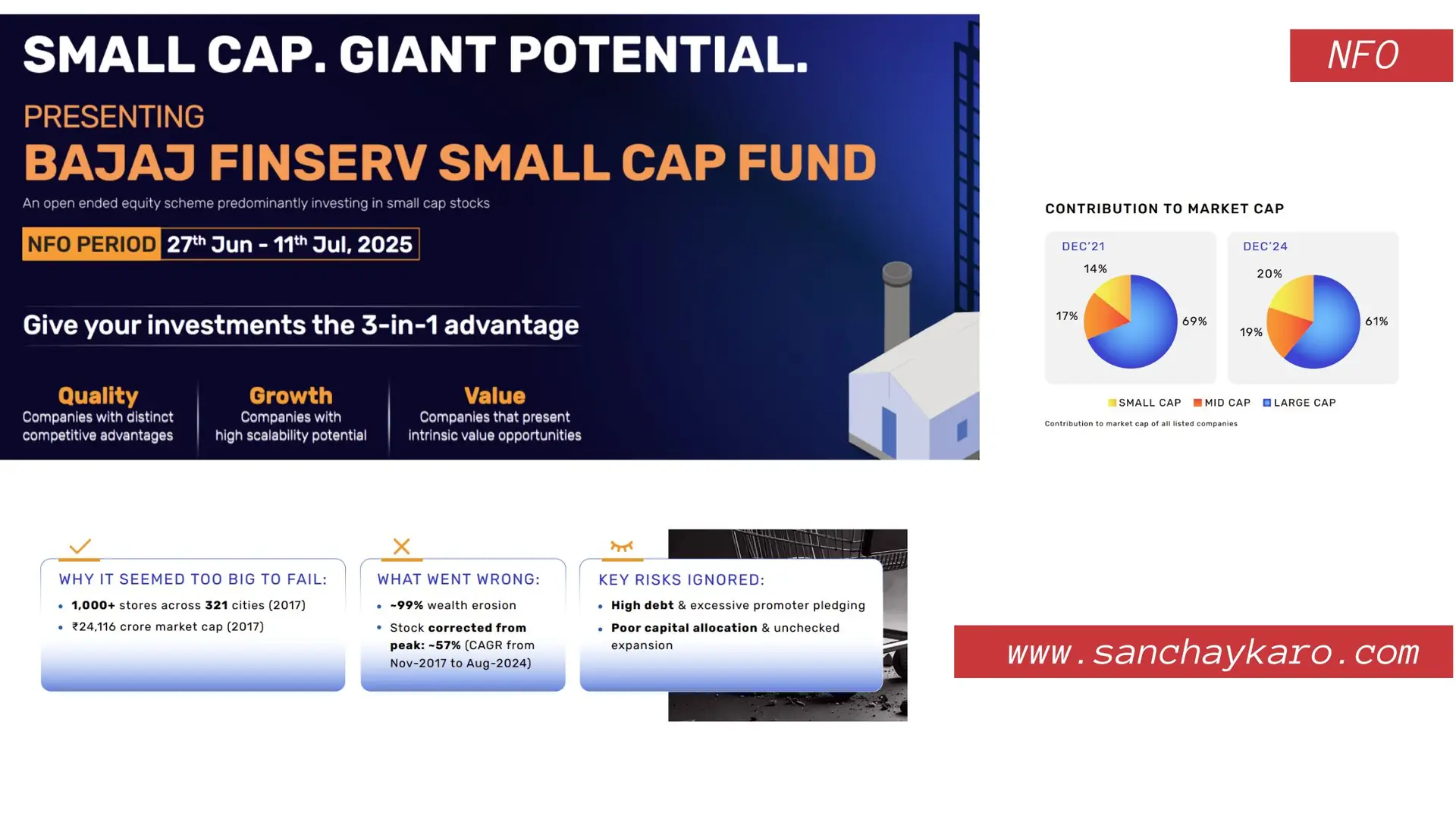

Bajaj Finserv Small Cap Fund

Small cap mutual funds are equity schemes that invest in companies ranked 251st and beyond in market capitalization. These businesses are smaller, but often have strong growth potential, making them attractive for long-term wealth creation.

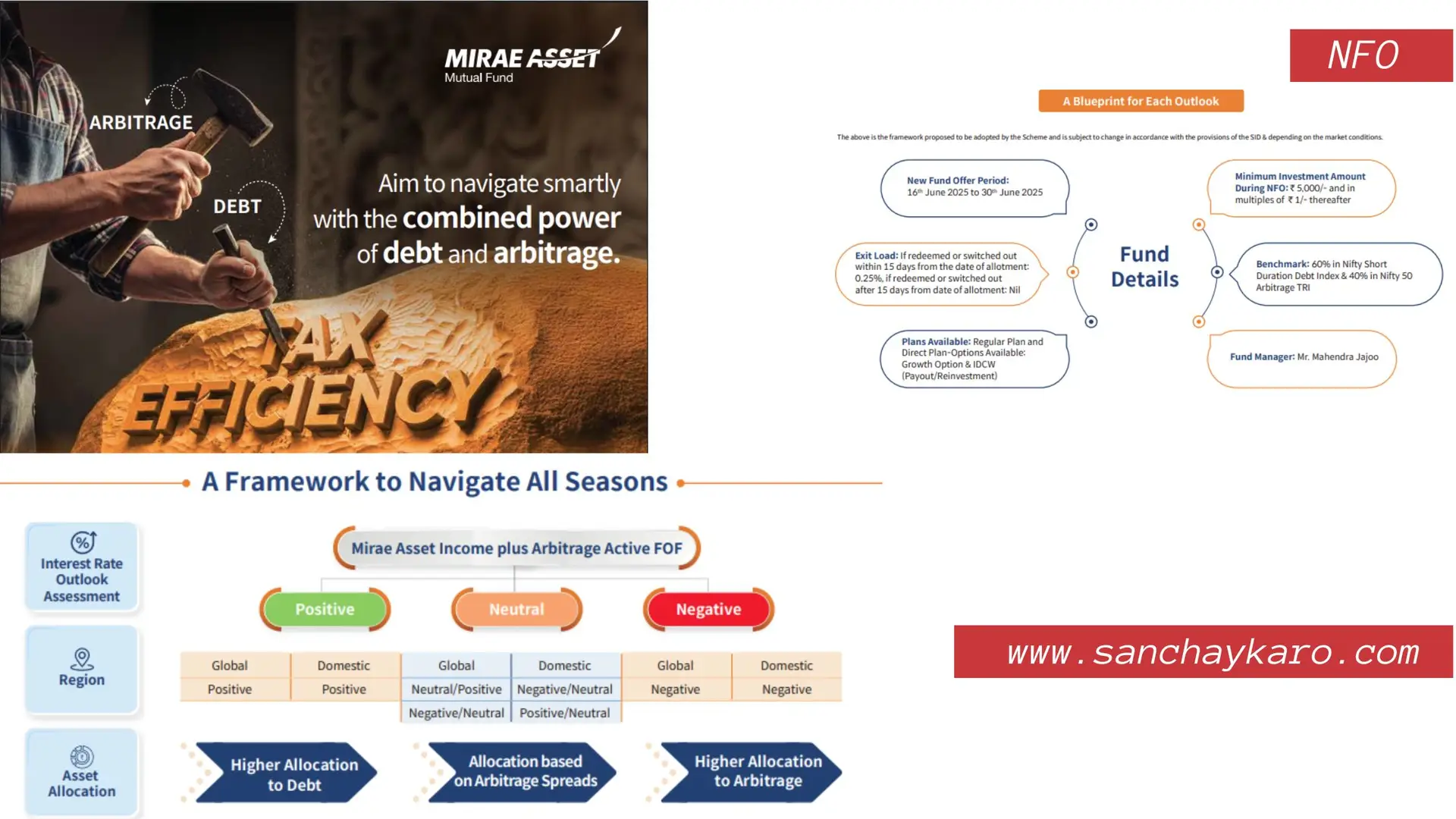

Mirae Asset Income Plus Arbitrage Active FOF

Mirae Asset Mutual Fund is launching a new fund offer (NFO): the Mirae Asset Income Plus Arbitrage Active Fund of Fund (FOF). This fund aims to deliver low-risk, steady returns by investing in arbitrage opportunities and other short-term fixed-income strategies.

One Stop Solution for Insurance, Investment & Wealth Creation

Welcome to Sanchaykaro, your trusted partner for financial freedom. Whether you’re looking to secure your family’s future through insurance, build long-term wealth with multibagger stock recommendations, or explore personalized loans and mutual funds — we’ve got you covered.

Add Daily SIP to Your Everyday Routine

Add Daily SIP to Your Everyday Routine and Transform Your Financial Future!

NPS Can Create a Massive Retirement Fund

Small, Consistent Investments in NPS Can Create a Massive Retirement Fund