For Just ₹500/Month, Term Insurance Secures Your Family’s Financial Future

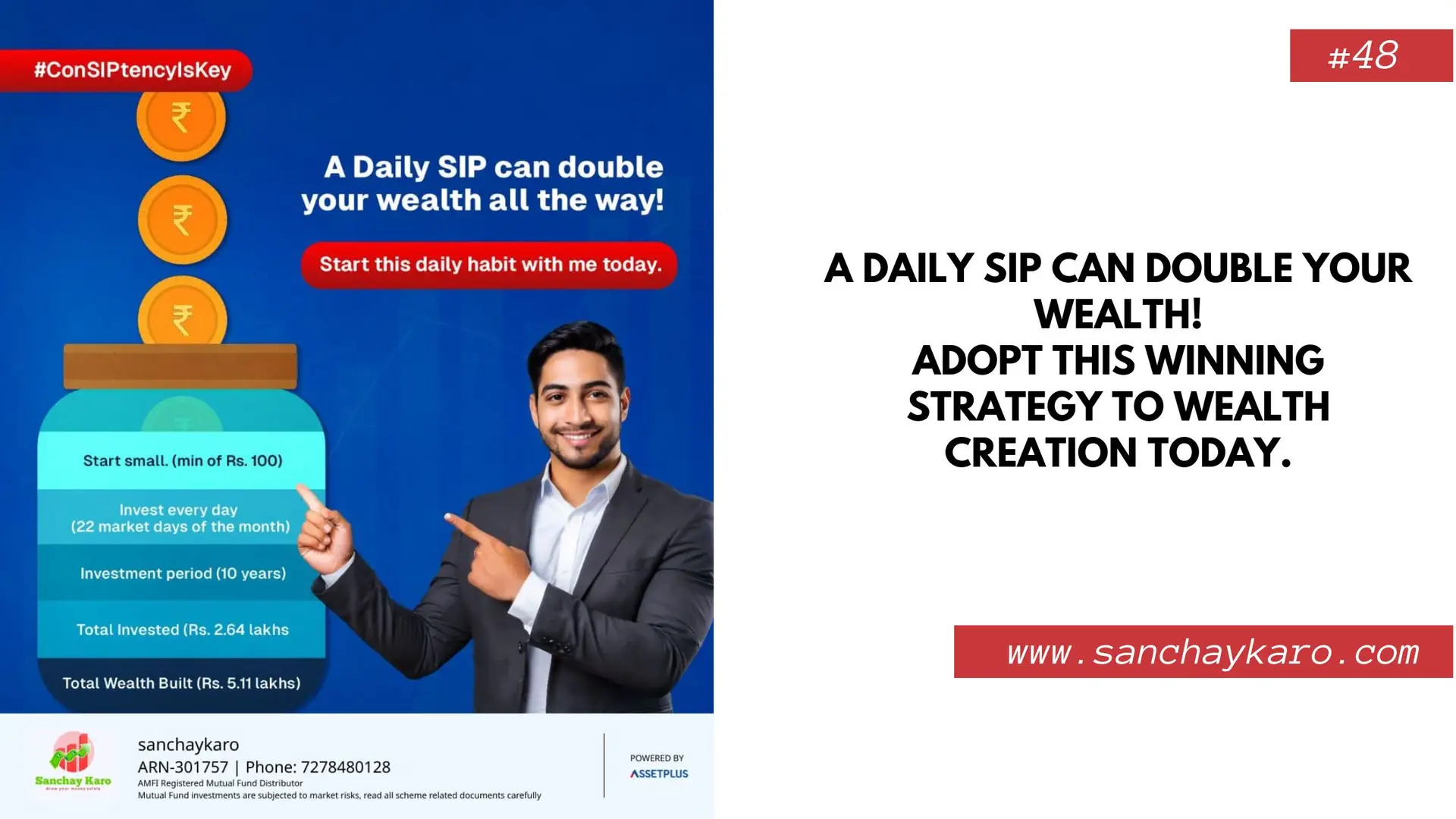

A Daily SIP Can Double Your Wealth!

Let’s break down what daily SIPs are, why they’re gaining popularity, and how you can start this smart journey toward financial freedom—just one day at a time.

Gold Mutual Fund Vs. Gold: Which One Wins?

In recent years, with the rise of digital finance and mutual funds, a new form of gold investment has gained traction – Gold Mutual Funds.

Apply for a Credit Card Online

In today’s digitally driven world, managing your finances smartly is more important than ever. A credit card is one of the most powerful tools to help you do just that—whether it’s building your credit score, earning cashback and rewards, or simply handling unexpected expenses.

Sagility India Ltd- A Potential Multibagger Stock for Long-Term Wealth Creation

Are you tired of losing money in F&O trading and want to build sustainable, long-term wealth? It’s time to shift focus toward fundamentally strong companies with multibagger potential. One such hidden gem we have on our radar is Sagility India Ltd, currently available around ₹40 per share.

Your Health Insurance Deserves a Birthday Too

This annual event is more than just a payment reminder. It’s your chance to review, reassess, and refresh your health coverage to ensure it continues to protect you and your family effectively. In other words, it’s a time to celebrate your continued medical security and make sure your financial shield is intact.

Get Your Credit Card with Instant Approval

In today’s fast-paced digital economy, having a credit card is not just a luxury—it’s a necessity. From online shopping and travel bookings to managing emergency expenses and building a strong credit score, a credit card plays a vital role in your personal financial toolkit.

Multibagger Stock Recommendation

Introducing the Multibagger Stock Recommendation – Paid Group by Sanchay Karo—an exclusive service where serious investors get access to handpicked stock ideas backed by deep research and high conviction.

Sanchay Karo Flagship Longterm Portfolio

In a world full of financial noise, market volatility, and too many short-term bets, one principle stands the test of time—long-term investing. For those who are serious about building wealth steadily and sustainably, Sanchay Karo brings an exciting opportunity: the Sanchay Karo Flagship Longterm Portfolio, now live on Smallcase.

9 High-Growth, Long-Lasting Multibagger Stocks

In this article, we explore 9 fundamentally strong, high-growth stocks across various sectors that have the potential to become the next generation of multibaggers in India. These companies offer robust earnings visibility, market leadership, and innovation-driven growth models — ideal for long-term investors.