🚀 Bajaj Finserv Small Cap Fund NFO – Should You Invest? | Complete Guide

📅 NFO Opening Date: 27th June 2025

📅 NFO Closing Date: 11th July 2025

🔗 Invest Now via Kfintech: Click Here to Invest

🔍 What is a Small Cap Fund?

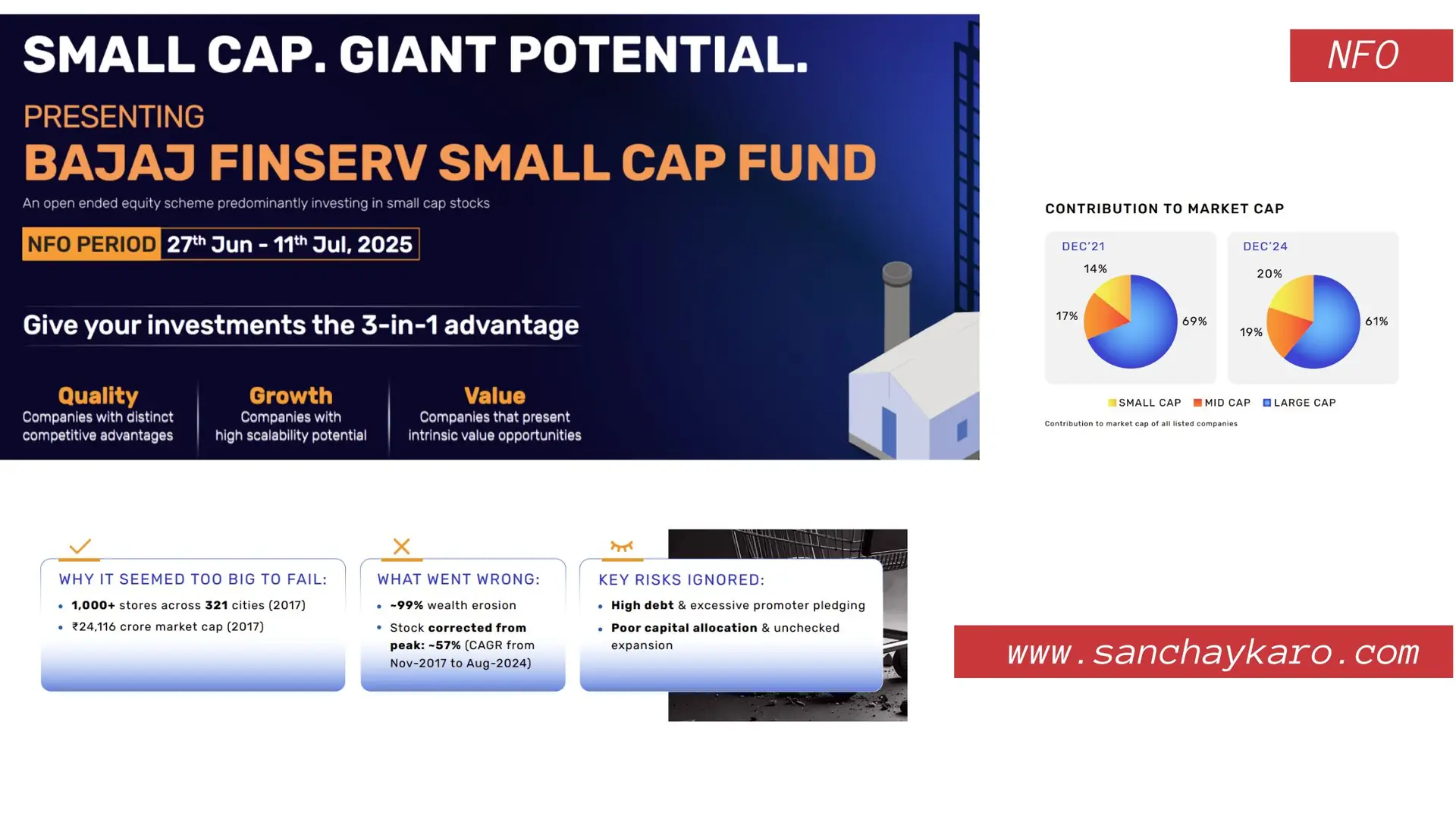

Small cap mutual funds are equity schemes that invest in companies ranked 251st and beyond in market capitalization. These businesses are smaller, but often have strong growth potential, making them attractive for long-term wealth creation.

Small cap funds are generally more volatile, but they can deliver multibagger returns over time.

🆕 About Bajaj Finserv Small Cap Fund

Bajaj Finserv Asset Management is launching a new fund offer (NFO) — the Bajaj Finserv Small Cap Fund — to tap into the high-growth potential of India’s emerging companies.

✅ Key Features:

- Fund Type: Open-ended small cap equity scheme

- Fund Manager: Yet to be disclosed (backed by Bajaj Finserv’s experienced team)

- Minimum Investment: ₹500

- Benchmark: Nifty Smallcap 250 TRI

- Risk Level: Very High

- Investment Horizon: Ideal for 5 years+

🎉 Good News!

The SanchayKaro Investment App is officially LIVE!

Now track & invest in mutual funds anytime, anywhere.

Download now 👇

📲 Android: https://play.google.com/store/apps/details?id=com.rrabbit.sanchaykaro&pcampaignid=web_share

📲 Apple: https://apps.apple.com/in/app/sanchay-karo/id6755289848

🌐 Visit: www.sanchyakro.com

Smart Investment. Simple Process. Secure Platform. 🔒📈

🧠 Why Consider This Fund?

1. Growth Potential

Small cap stocks are often in the early stage of their business lifecycle. Investing in such companies can generate multibagger returns, especially when backed by strong fundamentals.

2. Diversification

The fund will likely invest across various sectors, helping reduce sector-specific risks.

3. Managed by Experts

Bajaj Finserv Mutual Fund brings experienced fund managers and analysts, with a robust investment process.

4. Tax Efficiency

Like other equity mutual funds, long-term capital gains (LTCG) up to ₹1 lakh are tax-free.

📈 Who Should Invest?

This fund is suitable for investors who:

- Have a high risk appetite

- Want to diversify into small caps

- Are seeking long-term capital growth

- Can stay invested for at least 5 years

⚠️ Risks to Consider

- Small cap stocks are more volatile than large or mid caps.

- Liquidity can be an issue in extreme market conditions.

- Not suitable for conservative investors or short-term goals.

📝 How to Invest in Bajaj Finserv Small Cap Fund?

You can apply directly through Kfintech’s online platform.

Step-by-step Guide:

- Click the link above

- Log in or complete KYC

- Select the Bajaj Finserv Small Cap Fund

- Enter investment amount

- Confirm and pay

📢 Bonus: Multibagger Stock Recommendations (Premium Access)

Stop losing your hard-earned money in risky F&O trading!

📌 Switch to long-term investing with our SEBI-registered Research Analyst-backed stock picks.

✅ Features:

- Real-time buy/sell alerts via Telegram or WhatsApp

- Professional research and compliance

- Suggested holding: 6 months to 3 years

💡 Subscription Plans:

- Monthly: ₹999

- Yearly: ₹4999 (Best Value!)

🔗 Join Now

🆓 Want Free Lifetime Access?

You can get lifetime access to our premium stock recommendation group by opening a Demat account through our referral link and trading via it.

📝 Steps:

- Open Demat via our link → Open Now

- WhatsApp the following to 📱 7278480128:

- Your Name

- Mobile Number

- Registration Date

- Screenshot of Demat Account Opening

✅ Our team will verify and grant you free access.

Note: Inactivity or using a different Demat account will lead to removal during periodic review.

📲 Stay Connected

- Join our WhatsApp Channel → Click Here

- Join our Telegram Channel → Click Here

📌 Final Thoughts

The Bajaj Finserv Small Cap Fund NFO offers a promising opportunity to tap into India’s next wave of high-growth companies. If you’re ready to commit for the long term and accept some volatility, this fund could be a solid addition to your portfolio.

📅 Don’t miss the NFO window:

🟢 Opens: 27th June 2025

🔴 Closes: 11th July 2025

🔒 Disclaimer

We are not SEBI-registered investment advisors (RIA). This blog post is for educational purposes only. Mutual Fund and stock market investments are subject to market risks. Always consult a certified financial advisor before investing.

✅ SEBI-Registered Research Analyst Services (SANCHAYKARO)

🎯 Invest smart. Avoid gambling. Build wealth with research-backed strategies.