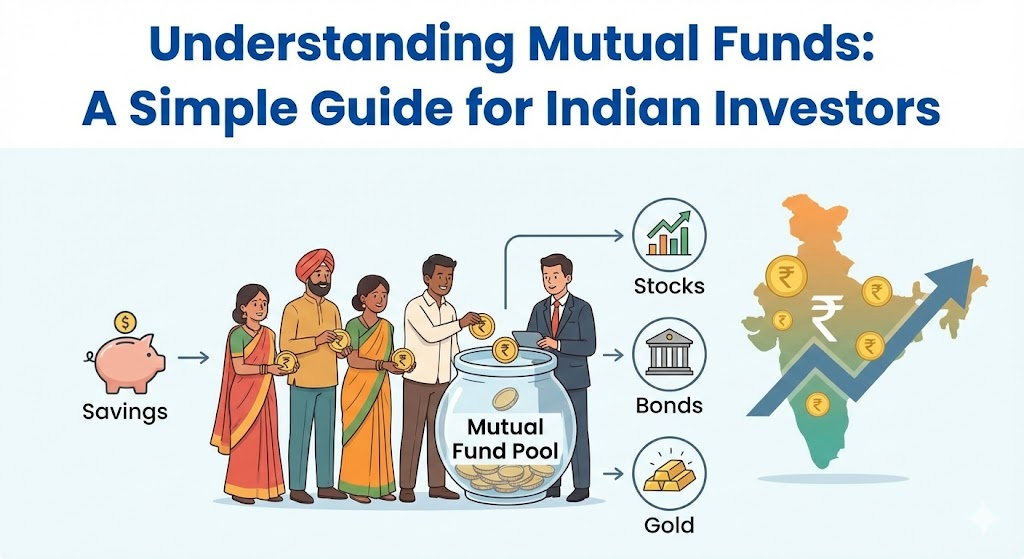

But times have changed. While our foundations in saving are strong, many of us remain trapped in outdated beliefs that hinder long-term wealth creation. Let’s explore the Indian money mindset, its hidden challenges, and how we can evolve it for today’s world.