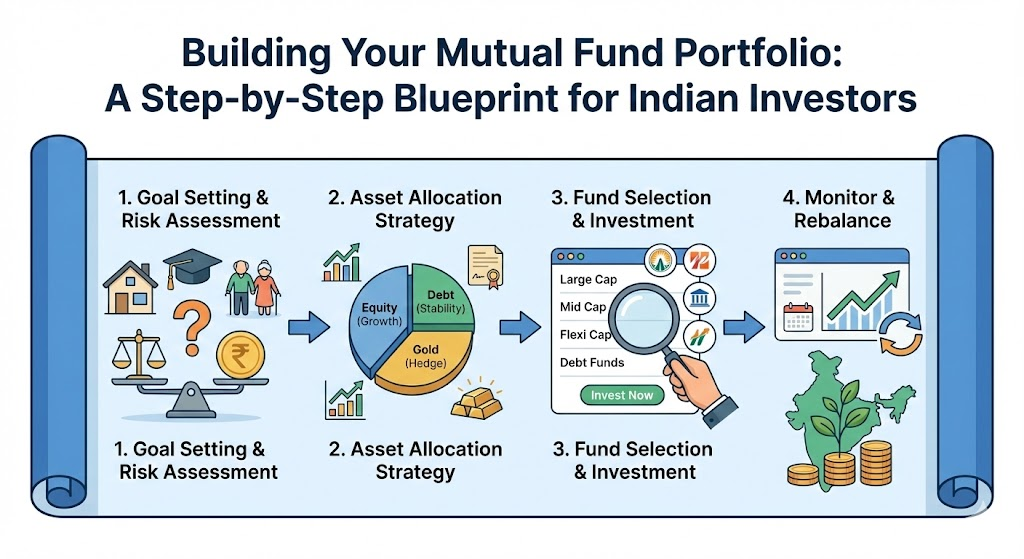

Creating a mutual fund portfolio can feel overwhelming, but it doesn’t have to be. Think of it as building a house—you need a strong foundation, the right materials, and a clear blueprint. This guide will walk you through constructing a portfolio that aligns with your dreams, not just market trends.

Start with Your “Why”: Define Your Financial Goals

Every successful investment journey begins with clarity. Before choosing a single fund, ask yourself: Why am I investing?

Is it for your child’s education? A comfortable retirement? Buying a home? Write your goals down—be specific.

- Short-term goals (<3 years): Vacation, car, emergency fund.

- Medium-term goals (3-7 years): Home renovation, child’s higher education.

- Long-term goals (10+ years): Retirement, financial freedom.

Example: Instead of “saving for college,” write “Build ₹25 lakhs for my daughter’s education in 10 years.” This specificity becomes your financial compass.

Assess Your Time Horizon and Risk Appetite

Your investment timeline and personal comfort with risk will shape your portfolio.

- Longer horizon = Higher risk capacity. A 30-year-old saving for retirement can consider more equity exposure than someone retiring in 5 years.

- Risk appetite isn’t just about courage. It’s shaped by income stability, responsibilities, and past experiences. Don’t copy someone else’s portfolio—wear shoes that fit you.

Master Asset Allocation: Your Portfolio’s Backbone

This is the golden rule. Asset allocation means dividing your investments across equity, debt, and other assets to balance growth and stability.

A simple starting point for a moderate-risk investor could be:

- 60% Equity Funds (for growth)

- 30% Debt Funds (for stability)

- 10% Hybrid/Gold (for balance)

This isn’t a one-time decision. Review your allocation at least annually or when your life goals change.

Choose the Right Funds for Each Goal

Match the fund type to the goal’s timeline:

| Goal Horizon | Recommended Fund Type | Why? |

|---|---|---|

| Long-term (10+ yrs) | Equity Funds (Large, Mid, Multi-cap) | Higher growth potential to beat inflation |

| Medium-term (3-7 yrs) | Hybrid or Balanced Advantage Funds | Mix of growth & stability |

| Short-term (1-3 yrs) | Debt or Liquid Funds | Capital protection & liquidity |

Avoid chasing past returns. Look for consistency, experienced fund managers, and a reputable fund house.

How Many Funds Do You Really Need?

More isn’t better. Over-diversification leads to overlap and complexity. Start simple:

- 1-2 Equity Funds

- 1 Debt Fund

- 1 Hybrid Fund

A manageable portfolio of 3-5 funds is often enough for a solid start.

SIP vs. Lumpsum: Choose Your Strategy

- SIP (Systematic Investment Plan): Ideal for regular, disciplined investing. Benefits from rupee-cost averaging—buying more units when prices are low, fewer when high.

- Lumpsum: Suitable for windfalls like bonuses. If markets are volatile, consider a Systematic Transfer Plan (STP) to phase in your investment.

🌱 Start Small, Think Big with a Chota SIP ✨

You don’t need a large sum to start. Begin with a small, consistent SIP and let compounding work its magic over time.

📲 Start Your Portfolio Today:

Android: Download App | Apple: Download App

The Critical Step: Regular Review & Rebalancing

Set a calendar reminder to review your portfolio once a year. Ask:

- Are my funds performing as expected?

- Has my asset allocation drifted? (e.g., equity increased to 75% from 60%)

- Have my life goals changed?

Rebalancing means selling some of the outperforming assets and buying underperforming ones to return to your original allocation. It enforces discipline—buying low and selling high.

A Real-Life Portfolio Example

Meet Rohan, 35:

Salary: ₹1 lakh/month | Monthly Investment: ₹20,000

| Goal | Horizon | Amount (Monthly) | Fund Type |

|---|---|---|---|

| Retirement | 25 years | ₹8,000 | Equity Multi-Cap Fund |

| Child’s Education | 15 years | ₹5,000 | Large & Mid Cap Fund |

| Home Renovation | 5 years | ₹4,000 | Balanced Advantage Fund |

| Emergency Corpus | Ongoing | ₹3,000 | Liquid Fund |

This structured approach aligns each rupee with a purpose.

Common Mistakes to Avoid

- ❌ Investing without clear goals

- ❌ Owning too many overlapping funds

- ❌ Ignoring asset allocation

- ❌ Chasing last year’s top performer

- ❌ Letting emotions drive decisions during market swings

Your Pre-Investment Checklist

Before you invest, ensure you can answer “YES” to:

- I have written down specific financial goals.

- I know the time horizon for each goal.

- I understand my personal risk appetite.

- I’ve selected funds that match each goal’s horizon.

- My portfolio is simple (3-5 funds) and balanced.

- I have a calendar reminder for my annual review.

Your Blueprint Awaits

Building a mutual fund portfolio isn’t about picking “winning funds”—it’s about creating a system that works reliably for your life. Start with your why, follow a balanced structure, and review with patience. The journey to wealth is built one disciplined step at a time.

✔ Smart Portfolio Building | ✔ Goal-Based Strategy | ✔ Secure, Simple Platform

Start your investment journey today — Build wealth with clarity, not confusion.