Disciplined investing refers to the habit of investing consistently, irrespective of market highs or lows. It’s not about timing the market — it’s about time in the market.

Simplify Investing with Mutual Funds

For many people, investing can feel confusing, risky, or even intimidating. Stock markets, IPOs, FD rates, inflation — it’s a lot to process. But here’s the good news:

How Much Time Period is Needed to Invest in SIP

How Much Time Period is Needed to Invest in SIP for Better Results?… In today’s fast-paced world, where everyone wants quick returns and instant profits, Systematic Investment Plans (SIPs) bring a breath of fresh air — offering a slow, steady, and reliable route to wealth creation. But one key question that investors often ask is:

Add Daily SIP to Your Everyday Routine

Add Daily SIP to Your Everyday Routine and Transform Your Financial Future!

NPS Can Create a Massive Retirement Fund

Small, Consistent Investments in NPS Can Create a Massive Retirement Fund

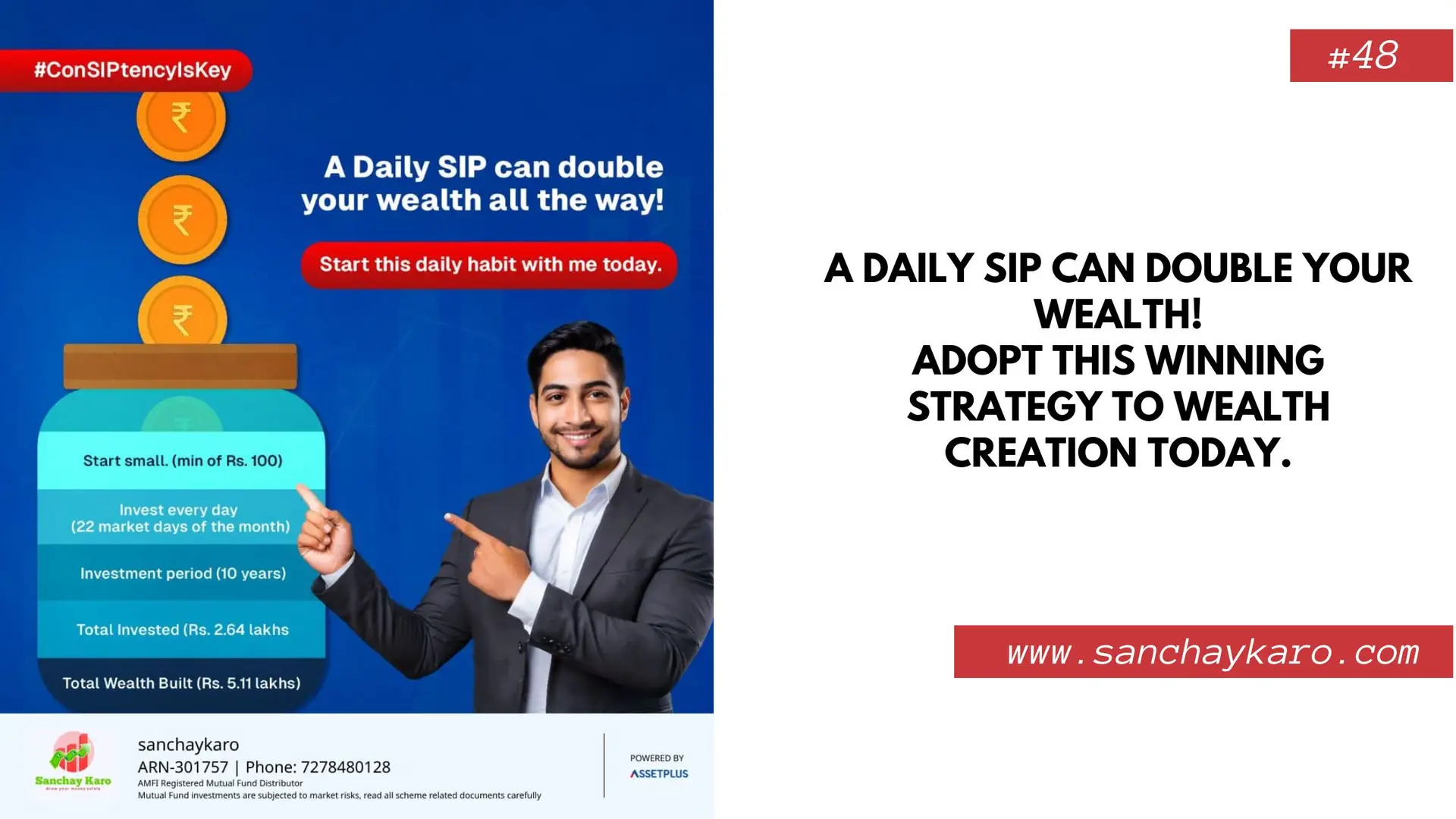

A Daily SIP Can Double Your Wealth!

Let’s break down what daily SIPs are, why they’re gaining popularity, and how you can start this smart journey toward financial freedom—just one day at a time.

Gold Mutual Fund Vs. Gold: Which One Wins?

In recent years, with the rise of digital finance and mutual funds, a new form of gold investment has gained traction – Gold Mutual Funds.

Why Invest in SIP

Why Invest in SIP? Embarking on your investment journey doesn’t require a hefty starting amount. With a Systematic Investment Plan (SIP), you can begin investing with as little as ₹100 per month. This approach not only makes investing accessible but also sets you on a path to building substantial wealth over time.