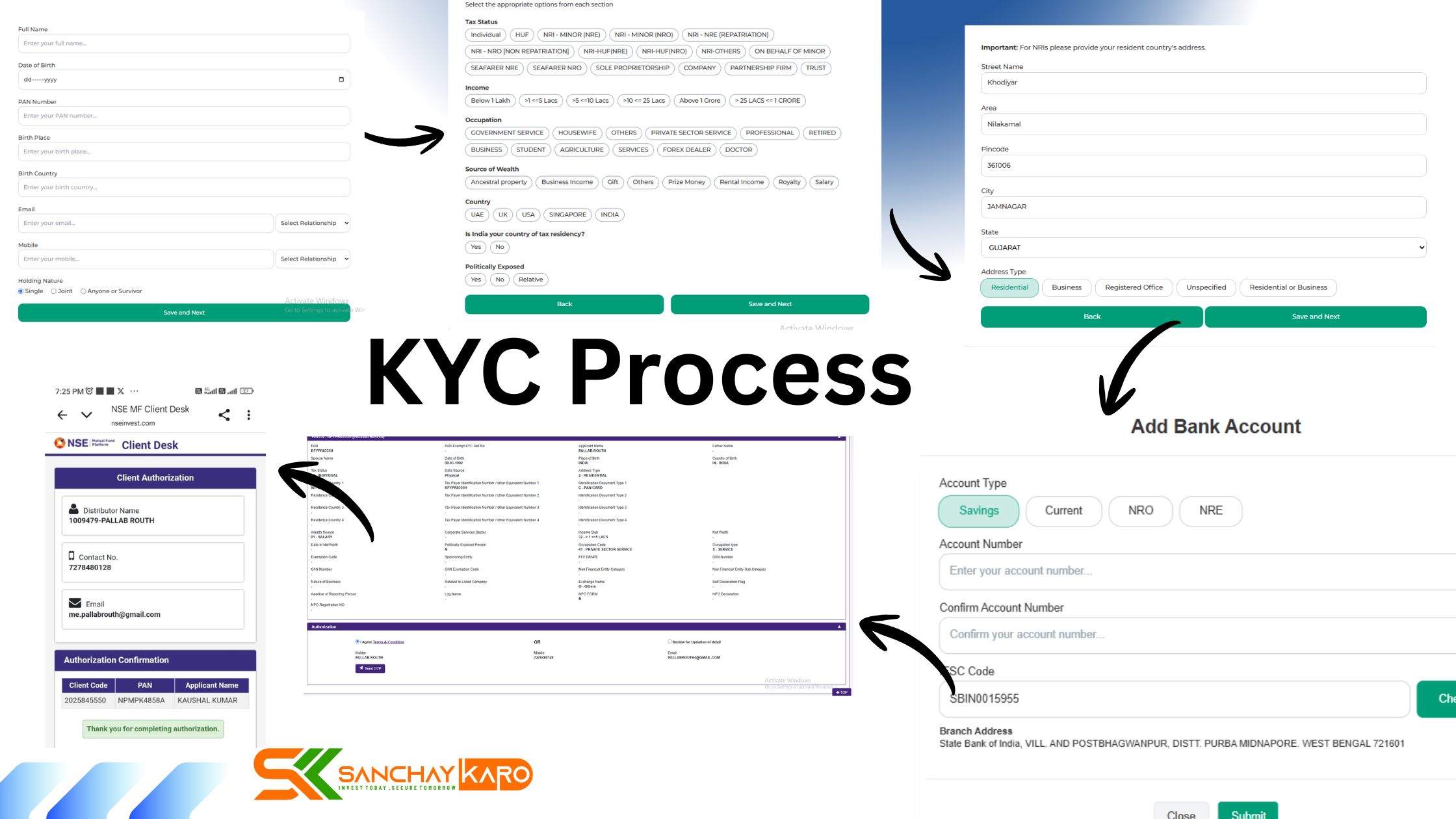

Starting your investment journey should be easy and fast. At Sanchay Karo, we have made the KYC (Know Your Customer) process very simple and quick.

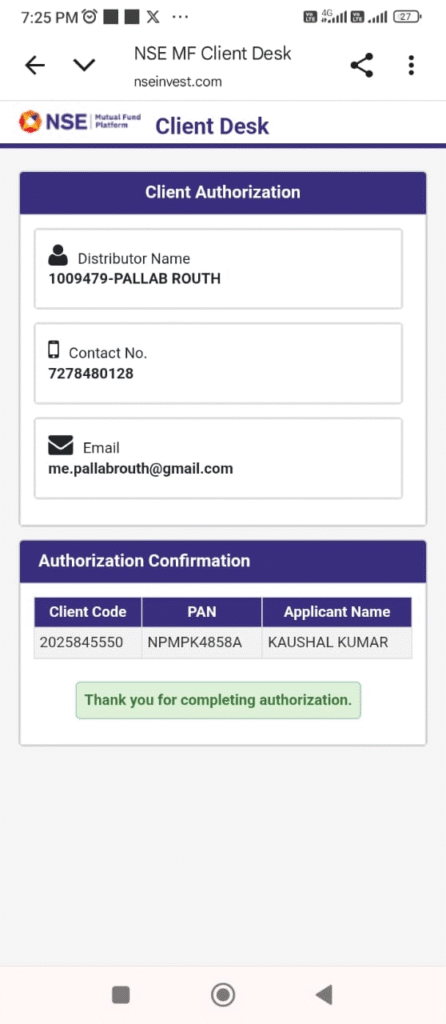

KYC is a mandatory step by SEBI for all investors in India. It helps us verify your identity and keep your investments safe and secure. We are Integrated With NSE API for Simplified KYC Process with Sanchay Karo useing ARN-301757 owned by Mr. Pallab routh .

How to Complete Your KYC with Sanchay Karo

Our process is designed to be smooth and can be completed in just a few minutes from the comfort of your home.

Step 1: Download the Sanchay Karo App

- Get the app for free from the Google Play Store or Apple App Store.

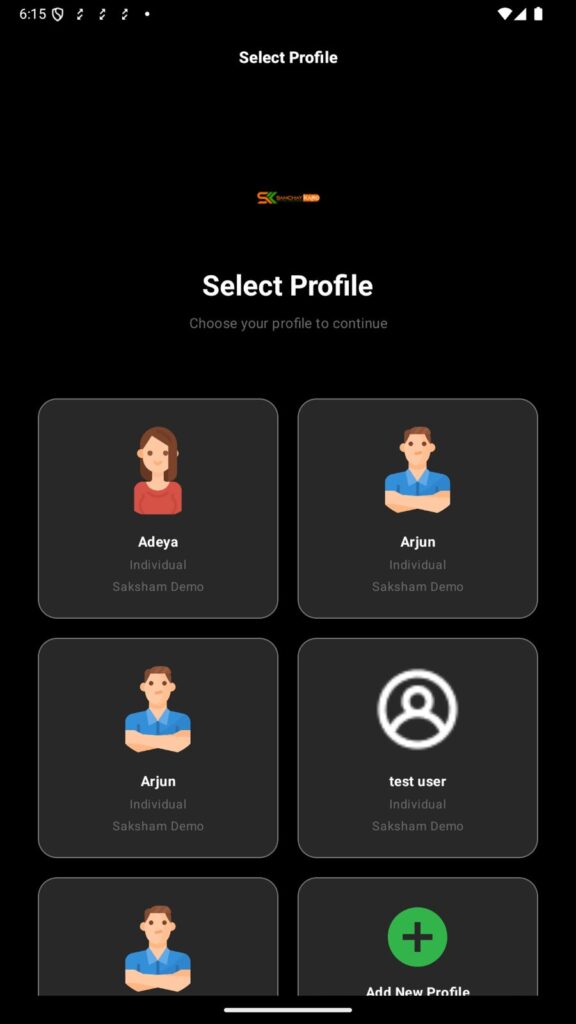

Step 2: Created your profile

- Open the app and enter your Mobile Number & Click for Proceed . You wil Geting a OTP in our Mobile – Do pest & Submit With basic details. Your profile Is ready

Step 3: Complete Your KYC

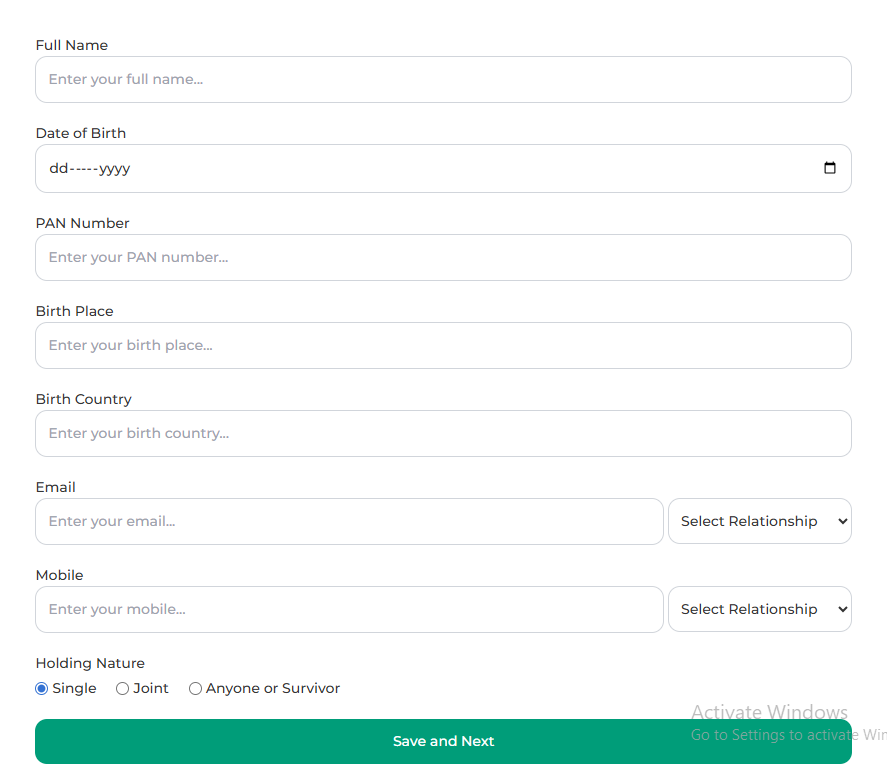

- Enter Your Full Name as Per PAN CARD , Death of Birth ,Birth Plase,Country ,Email,Mobile Number & click on Save & Next botton.

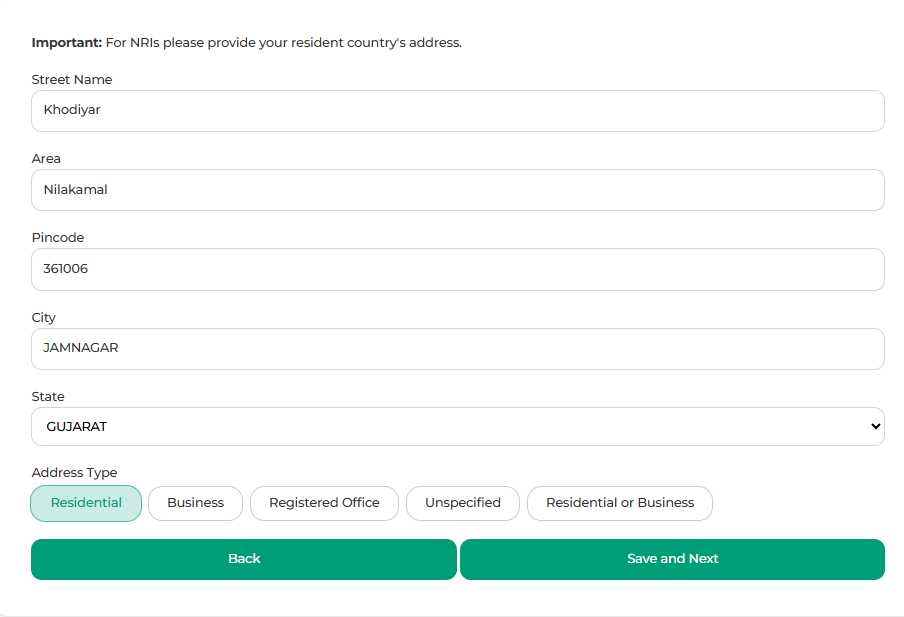

- Entre Your Residential Address Deatils like Streen name,Area, Pincode ,city, State & Address type & click on Save & Nest Button. ** For NRI customer, Please provide your resident country Address.

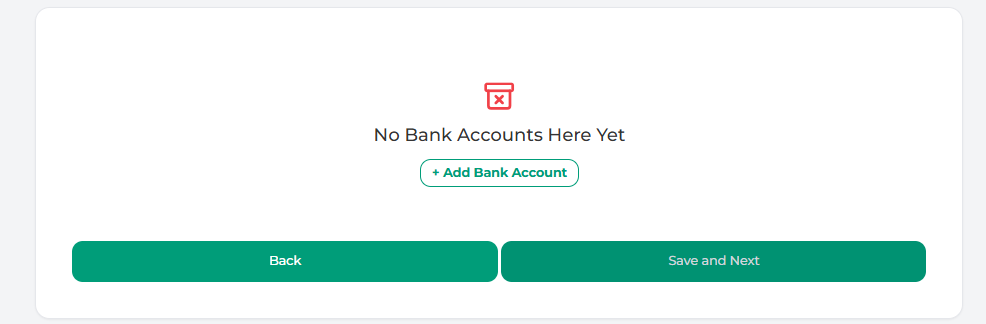

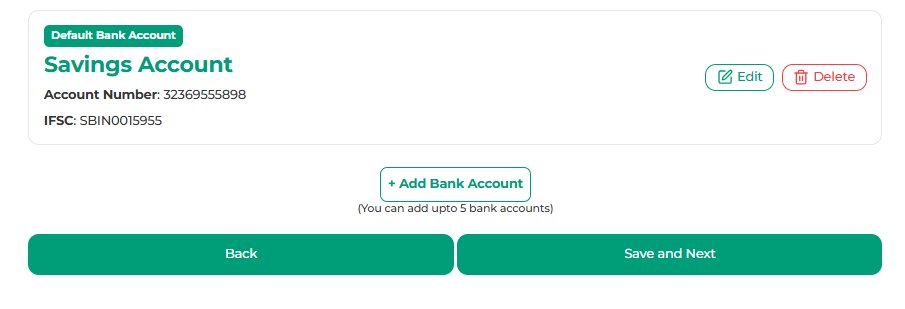

- click on Add Bank Account

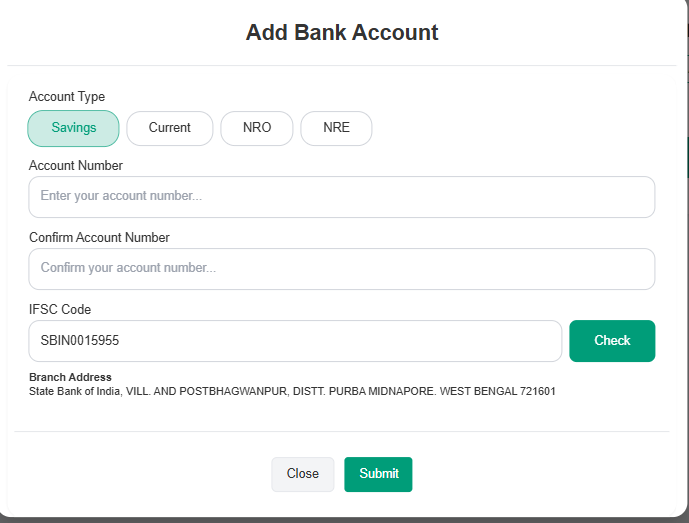

- Type your Account Type , Account number & IFSC code & click on Submit .

- After That click on Save & Next Botton.

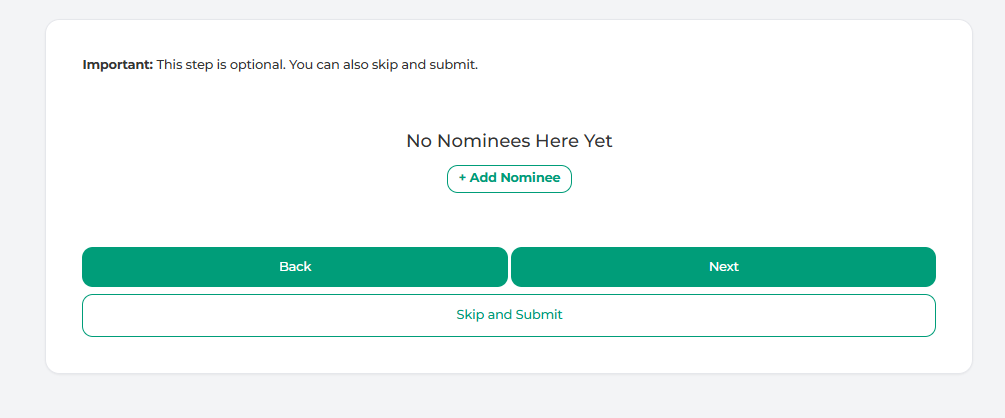

- Add your Nominees Details or You can Skip it by click on Skip & Submit Button

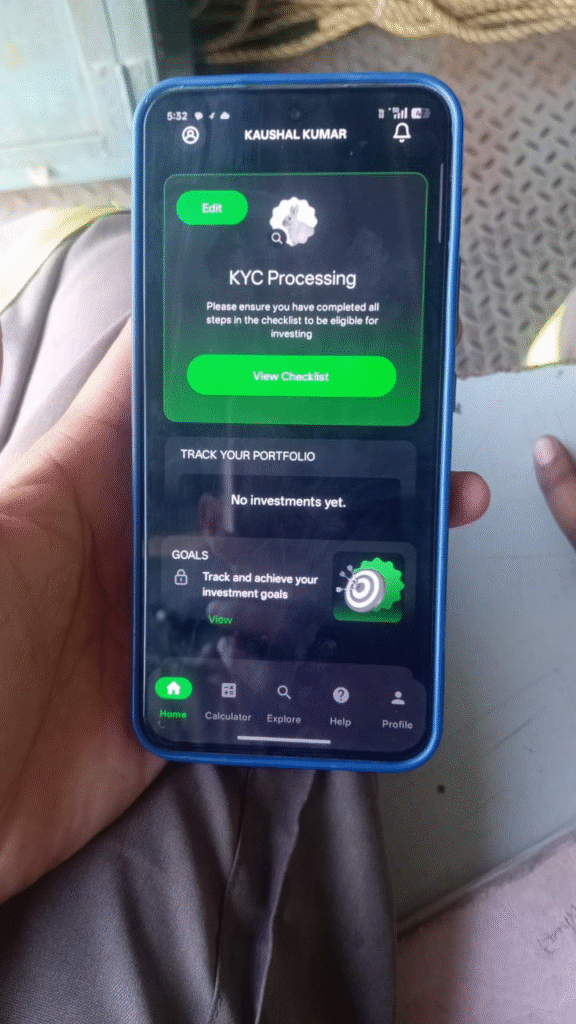

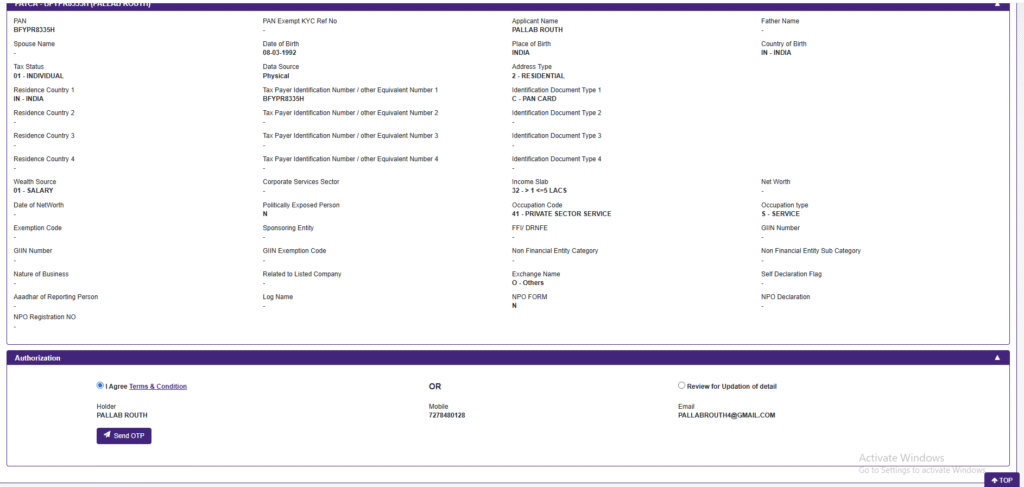

- After taht app will redirected a page on App “NSE” scroll on bottom, Check I agree Term & cindition & send OTP.

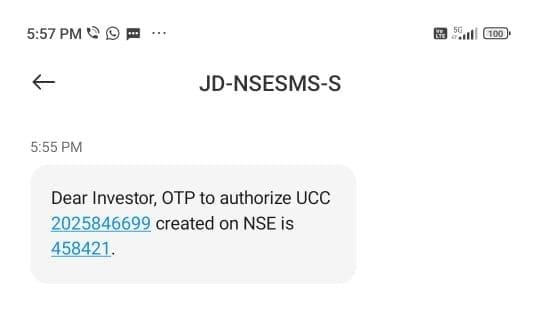

- You will get a OTP from NSE in your Registration Mobile Number -Pest & submit

- After that this Type of Page will open & bottom will Showing Thank you for Completeing Authorixzation.

Why is the KYC Process Important?

- Security: It protects your account from fraud and ensures that all transactions are secure.

- Regulatory Requirement: It is a mandatory process as per SEBI regulations for all investors.

- Smooth Investing: Once your KYC is complete, you can start investing without any interruptions.

Documents Required for KYC

- Full Name

- Pan Card number

- Death of Birtd

- Email Id

- Mobile Number

- Bank acoount details

- Nominees details (optional)

We Are Here to Help

If you face any issues during the KYC process, our customer support team is always ready to assist you. You can reach out to us through the app or visit our website at www.sanchaykaro.com.

Start your secure investment journey today. Complete your KYC with Sanchay Karo and unlock a world of simple, goal-based investing!